Part 2 in a series of letters to Trump voters

Exit polls and political pundits tell us Trump won the election largely because he was seen as strong on the economy. Voters believed he could turn their financial struggles into prosperity. In the wake of his victory, should the 75 million people who didn’t vote for him (48.4%) reflexively reject his economic agenda? Or should we support individual aspects where possible, attempt to work through differences, and oppose particular proposals when necessary? I’ll address these questions in this article, the second in a series of letters to Trump voters.

The president-elect made several commitments that, if realized, will benefit all or most Americans. These promises, however, are going to be difficult to keep, even with the significant gains already made in taming inflation and stabilizing prices. As Trump struggles to deliver, Democrats will almost certainly use the “politics of blame” to condemn his failed policies and decry his lies to the American people. After all, Trump did the same thing in blaming Biden for creating high inflation and ruining the personal finances of Americans. Why wouldn’t the Democrats return the favor?

I’m sorry, but the politics of blame only lead to division, anger, and frustration. Unless we do something different, Trump’s economic policies and goals are as sure to be condemned as those of Biden. Not convinced? Let me take you through the logic.

Setting aside a debate over the effectiveness of some of Trump’s solutions, there’s no reason why all or most Americans shouldn’t support Trump’s commitments and promises regarding inflation and prices.

Let me quote just two of Trump’s commitments and promises regarding inflation and prices. One is from the Republican party platform, and the other comes from the campaign trail.

“The Republican Party will reverse the worst Inflation crisis in four decades that has crushed the middle class, devastated family budgets, and pushed the dream of homeownership out of reach for millions. We will defeat Inflation, tackle the cost-of-living crisis, improve fiscal sanity, restore price stability, and quickly bring down prices.”

“I’m announcing today that under my leadership, the United States will commit to the ambitious goal of slashing energy and electricity prices by half, at least half. We intend to slash prices by half within 12 months and a maximum of 18 months.”

Trump at Asheville Rally (see minute 39) August 14, 2024

Who wouldn’t be in favor of defeating inflation and quickly bringing down prices? And who wouldn’t be in favor of cutting energy and electricity prices by at least half in 12 to 18 months? And who wouldn’t be in favor of his often-repeated promises to reduce interest rates, and cut car insurance rates in half?

Given the progress of the past two years, the stage is set for Trump to make good on his promises to slash prices.

I know that most of you, and the vast majority of Americans, continue to struggle with personal finances. The progress of the past two years is still not felt by hundreds of millions of Americans. But when we look at the facts, here’s the reality: inflation is mostly tamed, gas prices have almost returned to pre-pandemic levels, grocery prices have stabilized, and energy inflation has returned to pre-pandemic levels. Let’s look at the evidence.

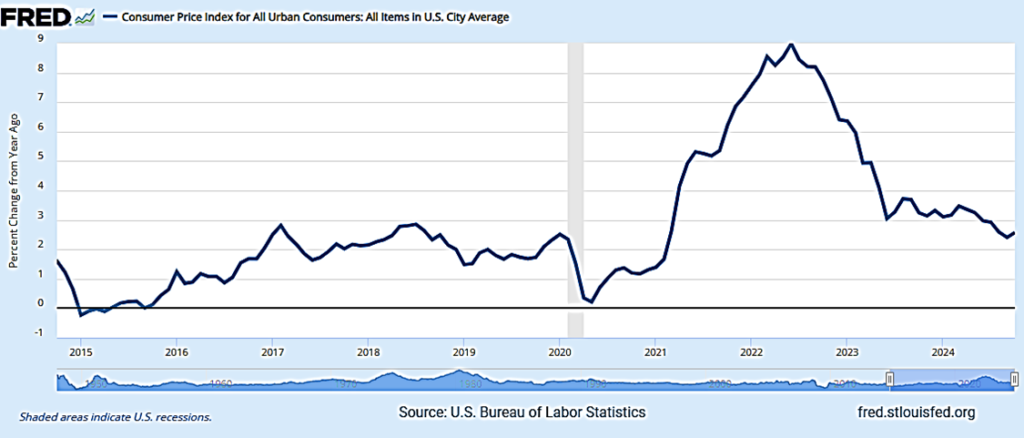

First, let’s look at the inflation rate, going back to 2015, displayed below.

You can see that during Trump’s term (2017-2021) the rate was generally in the range of 2% to 3%. The rate dropped sharply in early 2020, due to the Covid-19 pandemic and recession. Then the rate began spiking several months into Biden’s term (2021-2025). I’m sure you’re seeing the 40-year high of 9.1% in June 2022, and I will come back to this shortly. But by June of 2023, the inflation rate dropped to a near-normal 3%. For the last 18 months, the inflation rate has mostly stayed in the 2.4% to 3% range. Overall, the inflation rate has mostly returned to the pre-pandemic levels enjoyed during the Obama and Trump Administrations.

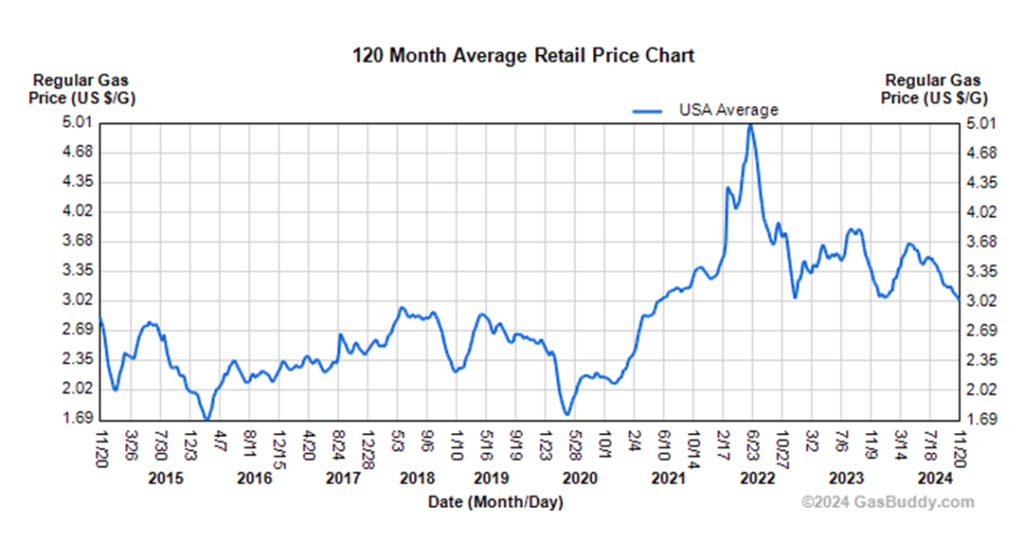

How about gas prices? Below is a chart from Gas Buddy showing gas prices (regular) over 10 years.

During Trump’s term (2017-2021) you’ll note that regular gas was generally between $2.50 to $3.00 per gallon. You’ll note steep drops in price in early 2016 (Obama) and December 2018, which were attributed to a glut in oil production in the US and worldwide. The price of gas also dropped sharply in the spring of 2020. The Covid-19 pandemic shut down economies worldwide, people weren’t driving, and there was a huge supply of gas.

As to Biden’s term, I’m sure you’ll notice and remember gas going to $5.00 per gallon in mid-June of 2022. Again, I’ll talk about this spike shortly. But by end of 2022, gas was back down to about $3.50 per gallon; and for the past 2 years it has ranged from $3.00 to $3.50 per gallon. Thus, gas prices are almost back to the levels that existed during Trump’s term.

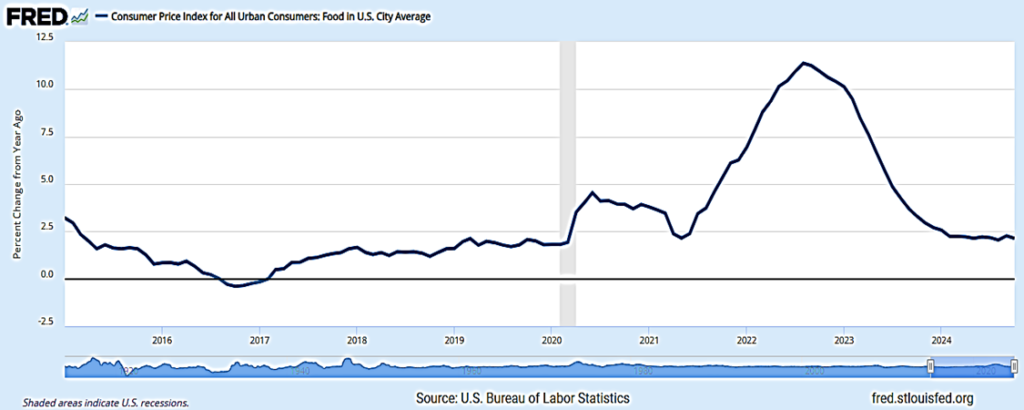

How about food prices (groceries at home and restaurants)? Below is a chart showing the US city average for food inflation going back to 2015.

As you can see, food inflation was very low at the end of the Obama Administration (2016) and the beginning of Trump’s term (2017). The inflation rate for food generally ranged between 1.5% to 2% up until early 2020. With the pandemic, food inflation spiked to 3.3% to 4.5% during the remainder of Trump’s term. By summer of 2021, food prices began spiking; and I’m sure you’ll notice and remember the peak of almost 11.4% in August of 2022. Again, I’ll address this peak shortly. But a year later (August 2023), the food inflation rate dropped back to the levels of Trump’s final year in office. And, since February 2024, food inflation is largely at pre-pandemic levels.

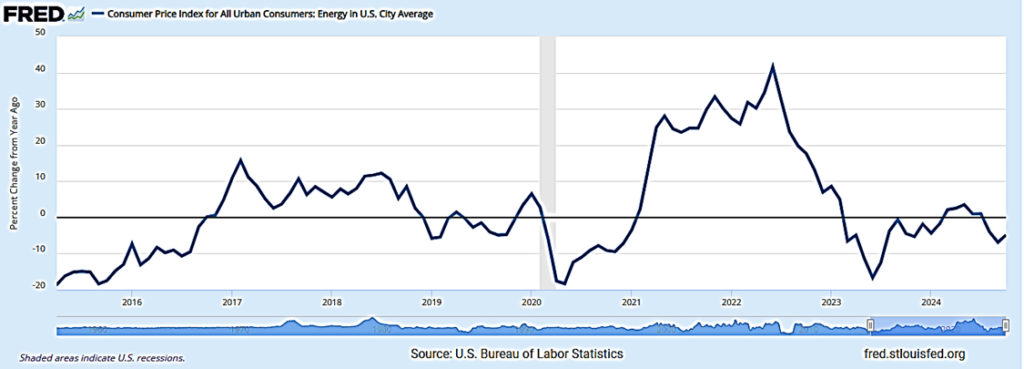

How about energy costs? Below is a chart showing inflation in energy costs (US city average) going back to early 2015.

You’ll note that energy inflation was actually negative in 2016, which was due to a glut in oil and natural gas production. Energy inflation was around 10% when Trump came into office. The rate of inflation varied between 3% and 10% until the end of 2018. The inflation rate went mostly negative during 2019, again due to a glut in oil and natural gas production. It climbed to around 6.5% just before the pandemic. Energy inflation then plummeted, coinciding with the pandemic; and the rate remained low (negative) during the remainder of Trump’s term.

As Biden took office in January of 2021, energy costs were already on their way up. By April of 2021, energy inflation was more than 20%, and the rate peaked at over 40% in June 2022. Again, I’ll address this peak shortly. But by November of 2022—2 years ago—energy inflation rates returned to the pre-pandemic levels of the Trump Administration.

Because of the very significant progress made during 2023 and 2024, the stage is set for Trump to make good on his promises to slash prices. We can all look forward to prices slashed below current levels or to levels that existed during his first term. Who wouldn’t get behind gas at $1.50 per gallon, along with 50% cuts in current rates for energy, groceries, car insurance, and other commodities?

But Trump’s promises to slash prices even further are going to be difficult to achieve because when inflation spiked in 2022, the high prices at that time got “baked in” and are declining stubbornly since then.

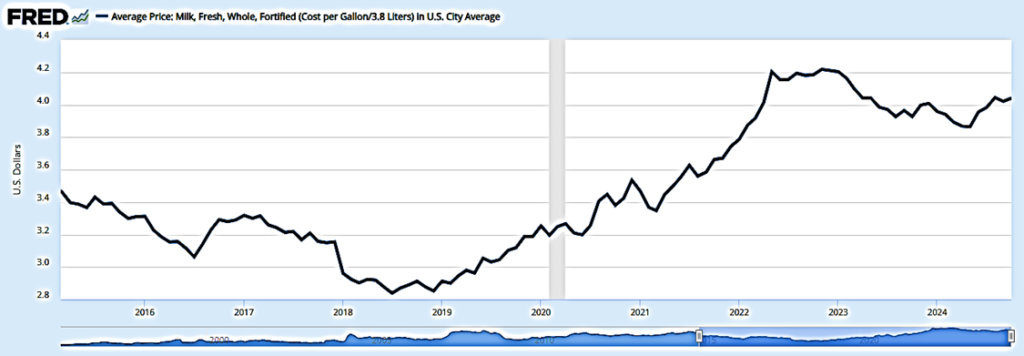

We can see how high prices get “baked in” by looking at the price of a gallon of milk over time.

Going back to 2015, milk ranged between $2.80 and $3.40 a gallon. Prices started to increase with the pandemic, and by December of 2020, milk was over $3.50 per gallon. By March of 2022, milk had spiked to $4.20 per gallon and remained around this level for many months. Early in 2023, the price of milk started to come down, but it still remains above $3.86 per gallon over the past 2 years. Thus, milk is about a dollar a gallon more expensive than it was prior to the pandemic.

For Trump to make good on his promise to reduce prices it’s not enough to keep inflation at or under 2%. Instead, for instance, he’s going to need to bring the price of milk down by a dollar a gallon. Bringing down prices will actually require inflation to be in the negative range.

For another example, let’s look at electricity prices. The average price for electricity was about 14 cents per kilowatt hour (kwh) during the period of 2015 until the start of the pandemic. The price spiked to 16.7 cents per kwh in August 2022. It has since hovered in the range of 16.5 to 17.8 cents per kwh. Trump’s promise to slash energy costs by half means that the price of electricity needs to come down to 8 or 9 cents per kwh. You have to go back almost 25 years to find electricity at this price.

Trump has just started to acknowledge that getting prices down will be difficult. In a recent interview with Time he said this about lowering the price of groceries: “It’s hard to bring things down once they’re up. You know, it’s very hard. But I think that they will. “

In summary, it’s clearly within reach for the inflation rate to drop to the accepted and ideal rate of 2%. We’re almost there right now. It’s also within reach for grocery and energy prices to stabilize and possibly drop a bit. But it’s an entirely different challenge to drop prices for food, gas, energy, and other costs to levels that existed during Trump’s term. And it’s an even more difficult challenge to drop prices and rates to half of what they are currently.

Trump used the “politics of blame” to pin responsibility on the Biden Administration for causing high inflation and prices.

Our review shows undeniable evidence that inflation spiked during Biden’s term (on his watch), whether it be the inflation rate, gas prices, food prices, or energy prices. All of our charts show rates and prices spiking and peaking in the spring, summer and fall of 2022. The evidence is also incontrovertible that hundreds of millions of Americans struggled and continue to struggle financially.

Trump put the blame on Biden, Harris, and the Democrats. He said their reckless and out-of-control spending created high inflation and prices. While there can be no doubt that high inflation happened during Biden’s watch, this does not prove that Biden caused this condition. Neither you nor I would blame Trump for the 20 million Americans who lost their jobs in early 2020. While this massive unemployment happened during his watch, the cause was the Covid-19 pandemic, not his policies.

Let’s look at Biden’s “massive spending” and particularly the stimulus package he proposed at the beginning of his presidency. Biden signed the $1.9 trillion American Rescue Plan Act into law on March 11, 2021. Trump and Republicans argue that this stimulus package was unnecessary, and that it was the primary driver of high inflation in 2021 and 2022.

Soon after The American Rescue Plan Act was signed into law, the inflation rate jumped to 4.16% (April 30, 2021), reached 7.04% by the end of 2021, and peaked at 9.06% on June 30, 2022. This seems like pretty damning evidence if it’s all you look at. But let’s dig deeper to see if there were other causes contributing to the steep increase in inflation.

During 2021 and 2022, the effects of the Covid-19 pandemic were still causing major economic problems. In particular, most countries in the world were struggling with supply chain issues and labor shortages. These problems translated into rising prices. During 2021 and 2022, inflation rates increased around the world. According to Statista, the global inflation rate for 2021 was 4.7%, and by 2022 reached 8.73%. Supply chain problems and labor shortages were clearly a contributing cause to high inflation that was occurring worldwide and within the US.

In addition, in February 2022, Russia invaded the Ukraine, setting off oil shortages and spiking prices for gas and food. This contributed to high inflation in the US and other countries.

In addition, in 2022, many American companies were making record profits, especially in the oil and food industries. This contributed to high inflation in the US.

Finally, if one is point to Biden’s spending as a primary driver, we need to examine other major spending in the same timeframe. The $900 billion Consolidated Appropriations Act of 2021 was signed into law by President Trump on December 27, 2020, just 75 days before the American Rescue Plan Act was signed. It’s difficult to argue that Biden’s spending was the sole cause of high inflation and Trump’s spending had zero effect.

While Trump used the “politics of blame” to paint Biden as the cause of high inflation, the facts say that high inflation was caused by a combination of factors, including: Biden’s spending, pandemic-related supply chain issues, Russia’s invasion of Ukraine, American companies making record profits, and even Trump’s stimulus spending. PolitiFact examined the claim that Biden’s spending sent prices skyrocketing and agrees with the conclusion of multiple contributing factors. It found most experts put Biden’s spending as contributing 2 to 4 points to the then 8.5% inflation.

Trump also used the “politics of blame” to pin responsibility on the Biden Administration for high interest rates that devastated the personal finances of hundreds of millions of Americans.

Beyond pinning high inflation on Biden, Trump went on to blame the Administration for creating “skyrocketing interest rates” that plagued Americans with credit card debt, made it impossible to purchase homes or autos, and ruined their personal finances. Further, Biden was doing nothing to bring rates down.

The fact is, however, that presidents have no control over interest rates. In our government this responsibility is vested with the Federal Reserve System, the central banking system of the US. The Federal Reserve Board (Fed) broadly controls monetary policy, with responsibilities to maximize employment, stabilize prices, and moderate long-term interest rates. Conditions such as recessions and high inflation require the Fed to act in meeting these responsibilities.

Most Americans probably do not know about the workings of the Fed. When inflation rates start go beyond the preferred or ideal rate of 2%, the Fed will usually act to raise the “federal funds rate.” These increases, in turn, influence “market interest rates” in the private sector, that in turn affect economic activity. Put simply, when the Fed raises interest rates, this tightens the money supply and cools the economy because borrowing money becomes more expensive. By slowing the economy down, inflation rates tend to come down. On the other hand, if the economy slows down too much, the Fed usually lowers interest rates in order to stimulate the economy and avoid a recession.

The Covid-19 pandemic created an intense but brief recession. It was short-lived primarily because the US and countries around the world adopted massive stimulus packages (government spending). Some 20 million Americans lost their jobs and economic activity slowed to a crawl. But the stimulus packages gave them money to spend and saved businesses from going under. In addition, the Fed lowered the federal funds rate to almost 0% in early 2020 to further stimulate the economy.

But stimulus spending is not a precise science and can be a double-edged sword. Not enough stimulus spending can cause an economy to fall into recession, whereas too much stimulus spending can lead to high inflation. The Fed, and not the US president, is charged with making this call.

Put simply, inflation rates started to increase in the spring of 2021, peaking at 7% by December, and going higher in early 2022. In March of 2022, the Fed finally took action to increase the federal funds rate, when the inflation rate had reached 8.5%. By July of 2023, the Fed had raised interest rates a total of 12 times, going from almost 0% to 5.3%, the highest level since 2001. And, as we have seen, in the 13 months between June 2022 and July 2023, the inflation rate did indeed drop dramatically.

Thus, President Biden was in no way responsible for either increasing interest rates or failing to lower them. The Fed has this responsibility. As the Fed increased interest rates, this eventually led to increases in our credit card rates, mortgage rates, auto loan rates, and other lending rates. Hundreds of millions of Americans were negatively affected. But Joe Biden was powerless to either increase or lower the federal funds rate. And while the Fed finally acted to lower interest rates in September 2024, the private sector has been slow to adjust its interest rates downward. Again, Joe Biden couldn’t control any of this.

Just as Trump used the “politics of blame” to his advantage, Democrats will surely use this stratagem to pin blame on the Trump Administration for failing to make good on promises and causing any economic problems that emerge.

Trump’s proposed tariffs are likely to cause inflation (see e.g., AP News , USA Today, and US Global Investors); and even the conservative Tax Foundation agrees). As soon as prices start going up, for any reason, Democrats will blame Trump for high inflation. He will be condemned for breaking his promises to the American people to slash costs for groceries, gas, energy and everything else.

If the cost of gasoline goes up because OPEC decides to reduce the supply of oil, Trump will be blamed. If the price of eggs goes up because an avian flu outbreak, Trump will be blamed. If credit card companies, banks, and other financers go slow on reducing their interest rates, Trump will be blamed for breaking his promise to slash interest rates. If interest rates do come down on mortgages, home prices will go up and Trump will be blamed for housing inflation. All this will be reported in the media, and Democrat politicians will repeat the messages 24/7. Democrats will say they turned the world’s strongest economy over to Trump and he promptly destroyed it.

If the National Debt goes up because of legislation to enact Trump’s tax cuts, this also has an inflationary effect. Trump will be blamed. In fact, if the National Debt goes up for any reason, Trump will be blamed.

I know you don’t want to hear this, but these blame tactics are likely to move the needle on Trump’s job approval ratings as well as threaten his policies and Republican control. Biden came into office with a 57% approval rating, and eleven months later (November 2021), it was down to 42%. In 2022, he lost control of the House of Representatives. In 2024, he backed out of running for reelection because he was losing badly in the polls. Trump, with his victory, is also likely to enter office enjoying relatively high approval. He will revoke hundreds of Biden’s executive orders and repeal signature legislative achievements of the Biden Administration. But he is likely to become unpopular because of relentless attacks by Democrats. An unpopular Trump, without control of Congress, opens the door for a Democrat to win the presidency. In that instance, Trump’s executive actions and signature legislative achievements are sure to be repealed to the maximum extent possible.

If we reject the “politics of blame” and recognize we’re all in this together, we should support and elect leaders who work to pursue common interests that all or most Americans can support.

I understand if you are skeptical about my analysis and want to see how far Trump can go to Make America Great Again. But watch what happens. Let’s see if Trump gets blamed for economic problems, high inflation, and not making good on his promises to slash prices. Let’s see if his job approval plummets and Republicans lose one or both houses of Congress in 2026. The alternative I’m advocating isn’t a return to Democrats using the blame game to impose their will. Rather, it’s rejecting the politics of blame and working together as Americans.

The future will inevitably present America with problems and challenges. There will be wars (with other countries or between other countries), recessions, pandemics, natural disasters, and other tragedies. We should be uniting to face these problems, especially when they are caused by factors beyond our control. We should be working together to solve these problems based on what is causing them. Pinning the blame on one another in order to win elections and impose our will is a dead end.

Yet as long as we keep supporting political parties and electing politicians who use blame, fear, and anger to win elections, we can never be united. As long as we continue to dwell in information silos that are biased and one-sided, we’ll keep embracing narratives that pin blame and stoke fear and anger. We, the American people, have to lead this change because our politicians, political parties, and their media allies have vested interests in the politics of blame.

We don’t need to be blaming and fighting one another on inflation and high prices. If we reject the politics of blame and inform ourselves more objectively, we’ll see the problems of inflation and high prices in a completely different light. High inflation was instigated by the Covid-19 pandemic, a great worldwide tragedy that triggered a recession. Stimulus spending was required to combat the recession. And, yes, stimulus and other spending by Biden had some effect on higher prices. But inflation was also stoked by supply chain problems, Russia’s invasion of Ukraine, Trump’s spending, and American companies seeking to make extra profits. The Fed acted to combat high inflation by increasing interest rates; and, historically speaking, interest rates came down in near record time. Still, this cure has been tough medicine for hundreds of millions of Americans. Fortunately, however, the Fed is now reducing interest rates. Americans currently enjoy the world’s strongest economy, and we have weathered most of the storm in terms of our personal finances.

I’m ready to reject the politics of blame–both from Republicans and Democrats–and charge our elected officials to work together to address economic challenges that will inevitably occur in the future. They should focus on cause, instead of blame. And they should focus on middle-ground solutions that serve the needs of most Americans, rather than the agenda of a political party. This will not happen unless you, Trump voters, want it to happen. And it will not happen unless those who voted for Biden or Harris want it to happen.

When you’re ready, I hope you’ll join the cause.

Leave a Reply