Part 4 in a series of letters to Trump voters

Many of you voted for Trump because you believe the federal government is far too big and wasteful. You disdain the Democrats who “tax and spend” to explode the National Debt, stoke high inflation, and decimate your paychecks. On the other hand, Trump delivered a major tax cut, The Tax Cut and Jobs Act (TCJA), during his first term of office. He pledges to both renew this legislation—making some changes permanent—and make good on promises made on the campaign trail, including:

- Eliminating taxes on tips

- Eliminating taxes on overtime pay

- Raising the child tax credit from $2,000 per child to $5,000 per child

- Getting rid of the cap on state and local tax deductions (SALT), or increasing the cap

- Getting rid of taxes on Social Security benefits

- Creating a deduction for auto loan interest

- Lowering the corporate income tax rate for domestic manufacturers to 15% (from 21% in TCJA)

This might surprise you, but the Democratic party and many of its members of Congress express support for many of Trump’s tax proposals. Democrats support renewing the TCJA cuts for all Americans except those making more than $400,000 a year. Since only 1.8% of American households make more than this amount, Democrats support 98.2% of Americans having their tax cuts renewed. Democrats also support not taxing tips and expanding the child tax credit.

There are two principal areas where Democrats differ from Trump. First, they are concerned about how to pay for the tax breaks. Because the cuts will significantly reduce federal revenue, this threatens to increase the already intolerable National Debt. Additional revenues are needed to avoid further ballooning the National Debt. Thus, Democrats propose to generate these offsetting revenues by increasing taxes on wealthy Americans and corporations. Rather than further cut the corporations tax, Democrats would put it back to prior levels.

Trump and Congressional Republicans respond with three arguments. First, they say additional revenue won’t be needed because they will enact massive cuts to undo profligate spending by Democrats. Second, under the “trickle-down theory,” tax breaks and benefits for corporations and the wealthy trickle down to everyone and create more federal revenue. And third, to the extent that offsetting revenues are needed, they can be secured by imposing tariffs.

So, who’s right? Will Republicans adopt massive cuts to federal spending? Does the “trickle-down theory” work, benefitting all and producing more revenue? Can we extend the TCJA and adopt additional tax cuts without significantly expanding the National Debt? And how might we come together to adopt tax reform that serves the vast majority of Americans without driving us further into debt? We can answer these questions by looking at trends over time. There’s plenty of hard evidence to inform our discussion.

Big federal spending increases have been necessary to address unexpected emergencies and economic conditions, regardless of the party in control of the White House and Congress.

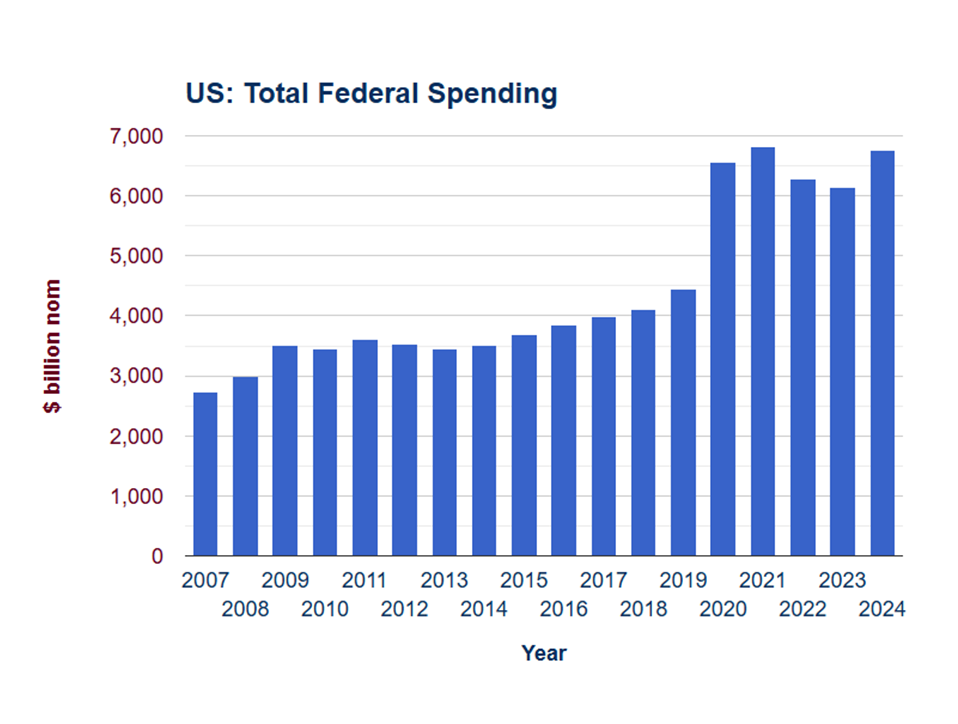

Below I display federal spending, going back to 2007, when George Bush Jr. was President. On a technical note, the year displayed is the federal fiscal year; thus 2007 goes from Oct 1, 2006 to Sept 30, 2007. Take a moment and assess what you see.

I’m betting the first thing most of you see is the huge jump in spending in 2020, when Trump was President. We see a slight increase in 2021, and the level of spending remaining high (over $6 trillion per year) from 2020 through 2024.

What happened in 2020? You would be correct in concluding the huge increase in spending was due to the Covid-19 pandemic and the massive stimulus packages enacted that year. To overcome a recession, skyrocketing unemployment, and business failures, the federal government allocated well over $3 trillion in stimulus relief during the last year of Trump’s presidency.

In 2021, with Biden as President, the $1.9 trillion American Rescue Plan Act was enacted, which caused spending to remain high. Republicans contended the emergency was over, while Democrats believed additional stimulus spending was still necessary. If you go back in time, you’ll see numerous instances where federal spending spiked for between one and four years to respond to recessions, wars, national emergencies (e.g., terrorist attacks of 9-11-2001), and pandemics. In fact, outside of these conditions, federal spending trends are mostly gradual, moving slightly up or down each fiscal year.

For instance, look at 2007 and 2008, the last two years of President GW Bush’s second term. You see spending went up gradually, even though a major recession started in December 2007. Spending then spiked in 2009, due to a major stimulus relief package to combat the recession. Spending remained high for the next three years, before declining in 2013 and remaining flat for the remainder of Obama’s term. But for the remainder of Obama’s term (2010-2016) federal spending was relatively flat.

Because major spending for unexpected emergencies and economic conditions is not budgeted, each time such an event occurs the US incurs a sizable Budget deficit for the year(s) the conditions last.

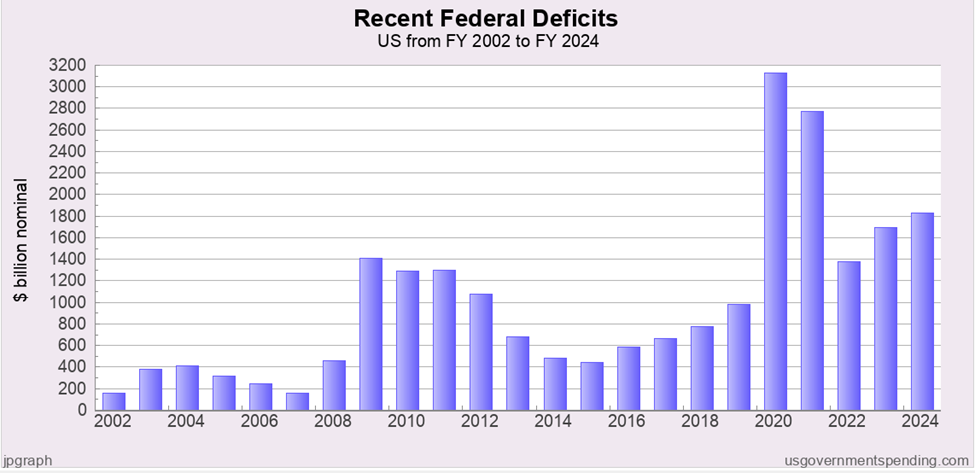

Below I display recent Budget deficits (in billions of dollars) going back to the 2002 fiscal year. Take a moment and assess what you see.

The first big jump chronologically is a Budget deficit of $1,400 billion ($1.4 trillion) in 2009. This was due to the major recession that came at the end of Bush’s term and the huge stimulus spending during the first year of Obama’s term. You’ll see that annual budget deficits declined somewhat during the remainer of Obama’s first term and dropped substantially during his second term. Deficits edged up from $600 billion to $1 trillion during Trump’s first three years.

Then the deficit exploded to over $3.1 trillion in 2020, Trump’s last year. Again, this was due to a recession (over 14 million Americans lost their jobs and weren’t paying taxes), and huge stimulus spending. Annual deficits dropped somewhat during Biden’s term but remain at historically high levels.

The federal government, regardless of the party in control, consistently spends far more than it takes in (revenue); and this, in turn has caused the National Debt to grow, regardless of which party is in control.

If you look at the prior chart, you’ll notice a Budget deficit for every year going back to 2002. This means the federal government consistently spends far more than it takes in. Regardless of who is in the White House and controls Congress, deficits have occurred every year.

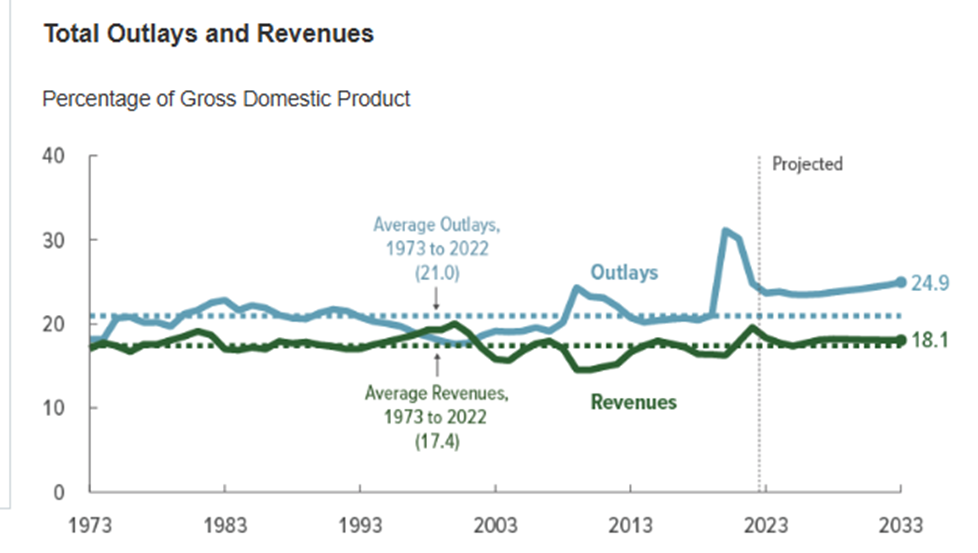

Not to get too deep into the weeds, but another way to illustrate this problem is to look at spending (outlays) against revenues as a percentage of the Gross Domestic Product over time. Take a look at the chart below.

Going back to 1973, you’ll see that we consistently spent far more than we took in. The only exception was in the early 2000’s. During the nearly 50-year period of 1973-2022, we spent an average of 21% of GDP each year, while we only took in revenues that averaged 17.4% of GDP. This, my friends, does not represent good fiscal stewardship by either Democrats or Republicans.

When you have Budget deficits each year, and sometimes big deficits due to unexpected emergencies and economic conditions, this accumulates into a huge National Debt.

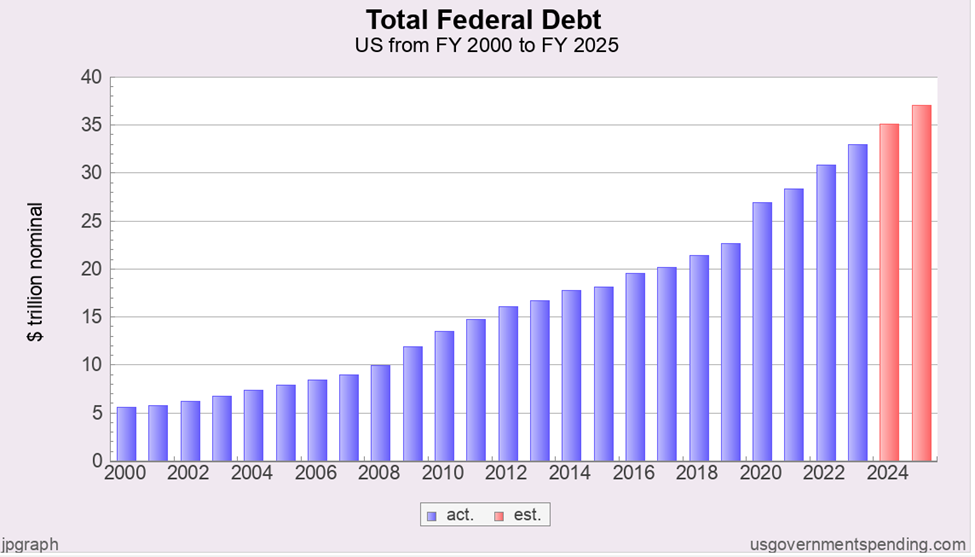

Below I display the National Debt going back to 2000.

As you can see, the National Debt has gone up consistently and strongly over this period. It has gone up under both Republican and Democratic Presidents, and under both Democratic and Republican control of Congress. For instance, it grew from $20 trillion to $27 trillion in Trump’s first term; and from $28 trillion to over $36 trillion during Biden’s term.

Prior experience with the “trickle-down theory” mostly demonstrates that extending tax cut benefits to wealthy Americans and corporations neither trickle down to all Americans nor produce more revenue than if the tax cuts had not been enacted.

Going back to 1980, Republican presidents have successfully pressed for tax cuts that benefit the wealthy and corporations, in addition to everyday Americans. Several major tax reforms were enacted, including the Reagan tax cuts, the Bush tax cuts, and the Trump tax cuts.

In November 2024, Investopedia negatively evaluated trickle-down proposals, concluding:

“In December 2020, a London School of Economics report by David Hope and Julian Limberg was released that examined five decades of tax cuts in 18 wealthy nations. It found they consistently benefited the wealthy but had no meaningful effect on unemployment or economic growth.”

If you want to know more about this report, see this CBS analysis from 2020 that say the tax cuts for the rich didn’t trickle down.

In April of 2024, the Center for American Progress released a report on the TCJA, concluding that:

- Corporate investment actually slowed after passage of the TCJA

- The corporate tax cuts did not trickle down to ordinary workers

- Instead of boosting wages and corporate investment, stock buybacks increased in the wake of the TCJA

- The TCJA did not pay for itself

- The TCJA’s business tax changes permanently reduced federal revenues

A separate analysis by The Institute on Taxation and Economic Policy (ITEP) found that during the first four years after former President Donald Trump’s tax cuts took effect, the country’s largest corporations collectively spent $2.72 trillion repurchasing their own shares—more than the $2.65 trillion they spent “on investments in plants, equipment, or software that might have created new jobs and grown the economy.”

On the other hand, some analyses are more circumspect about whether the TCJA achieved its purposes. An analysis from the Peter J. Peterson Foundation does a good job of describing the different points of view. And an analysis from Congressional Republicans (House Committee on the Budget) discounts analyses from the Congressional Budget Office and argues the TCJA was a boon to America’s economy and working families.

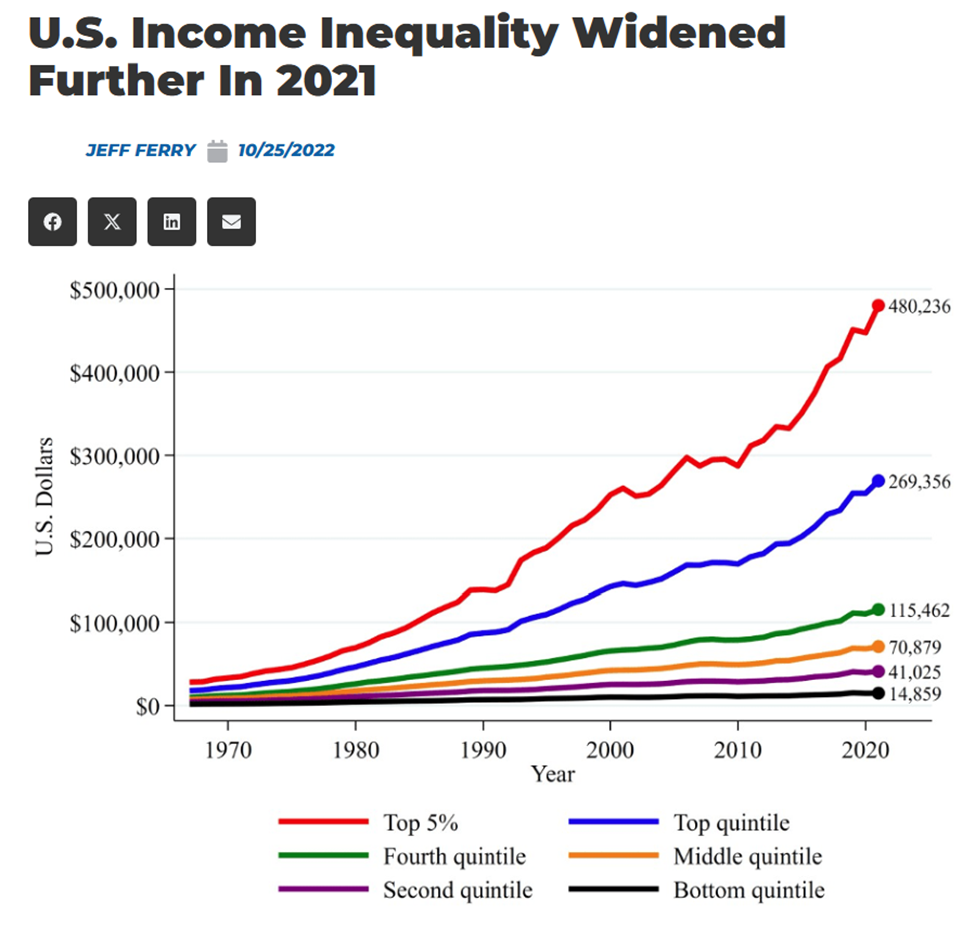

I recognize that you may not be convinced that “trickle-down” tax proposals don’t work in stimulating the economy, reaching all workers, and producing more federal revenue. I stand by my analysis, especially because of the growing disparity in income inequality in America. In my view, the chart below says it all.

As you can see, the rich are getting richer, and the poor and middle class are going nowhere. Since 1981, when the first trickle-down tax proposals were enacted, those at the top are the ones seeing a large increase in wealth and income. By comparison, those on the bottom or middle are seeing very small gains.

Prior history predicts there will be no political appetite for slashing federal spending, and the fiscal impacts of tariffs can’t be assessed until they are levied and remain in place for some time.

Trump and the Republicans, when in control of both the White House and Congress during his first term, did not act to slash federal spending. In fact, during Trump’s first 3 years, spending increased from about $4,000 billion to $4,500 billion. This was before the huge spending for the Covid-19 pandemic in 2020. Also, annual deficits increased from $600 billion to $1 trillion during the same 3-year period. Trump has promised not to touch the entitlement programs (Social Security, Medicare) that make up a huge part of federal spending. He also won’t cut defense.

I understand that you want to give Trump and Republicans a chance to make huge cuts in federal spending. I’m just saying prior history tells us it’s not likely to happen. The fact that Trump recently urged Congress to increase or get rid of the Debt Limit is not a sign that he plans on lowering the National Debt. Indeed, it’s a sign that he anticipates additional spending for priorities such as border security, and additional revenue loss from his package of tax cuts.

Tariffs, once decided and imposed, could have a significant fiscal effect. They could yield hundreds of billions of dollars in new federal revenue. But we won’t know until they specifically decided and put in place. And we don’t yet know what will happen if the costs of tariffed goods get passed on to American consumers. Will there be a backlash when prices go up? And what does this do as to Trump’s promises to lower prices?

Again, I respect your stance that tariffs ought to be given a chance. I’m simply saying we can’t be certain at this early stage whether tariffs will cover the revenue shortfall that occurs when Trump’s tax cuts are put into place.

While the cost of Trump’s tax cut proposals can’t be determined until the details of the package are decided upon and enacted, the cost of renewing the Tax Cut and Jobs Act and his additional promises made on the campaign trail is in the range of $4 to $7 trillion dollars over the next 10 years.

In a mid-November analysis CNN stated:

“. . .Trump’s extensive tax wish list is very pricey and comes at a time when the nation’s debt is rising swiftly. Extending the 2017 Tax Cuts and Jobs Act could cost more than $4 trillion, and the incoming president has promised more than $3.3 trillion in tax relief measures on top of that.”

And an analysis in Yahoo Finance found the following, which I quote below:

- “Extending the expiring 2017 tax cuts would cost $4.6 trillion over 10 years, according to the Congressional Budget Office.

- Lowering the corporate tax rate from 21% to 15% would shave another $874 billion from federal revenues, according to the Committee for a Responsible Federal Budget.

- Raising the child tax credit from $2,000 per child to $5,000 would cost some $3 trillion.

- Exempting Social Security benefits from taxation would cost another $1.8 trillion, while Trump’s “no tax on tips” pledge would trim $250 billion in revenues.”

The Tax Foundation, an organization friendly to the right, released a detailed analysis in mid-November. It calculated the cost of all the proposals ($6.7 trillion) and then offset this cost with estimates of revenue from tariffs ($3.82 trillion) and repealing green energy tax credits ($921 billion) under the Inflation Reduction Act. This left a cost of over $1.9 trillion. Also, the cost of exempting Social Security benefits from taxation ($1.8 trillion) was excluded from its analysis.

Given the size of the National Debt and the interest cost to carry it, the option of funding the tax breaks through deficit financing should be taken off the table.

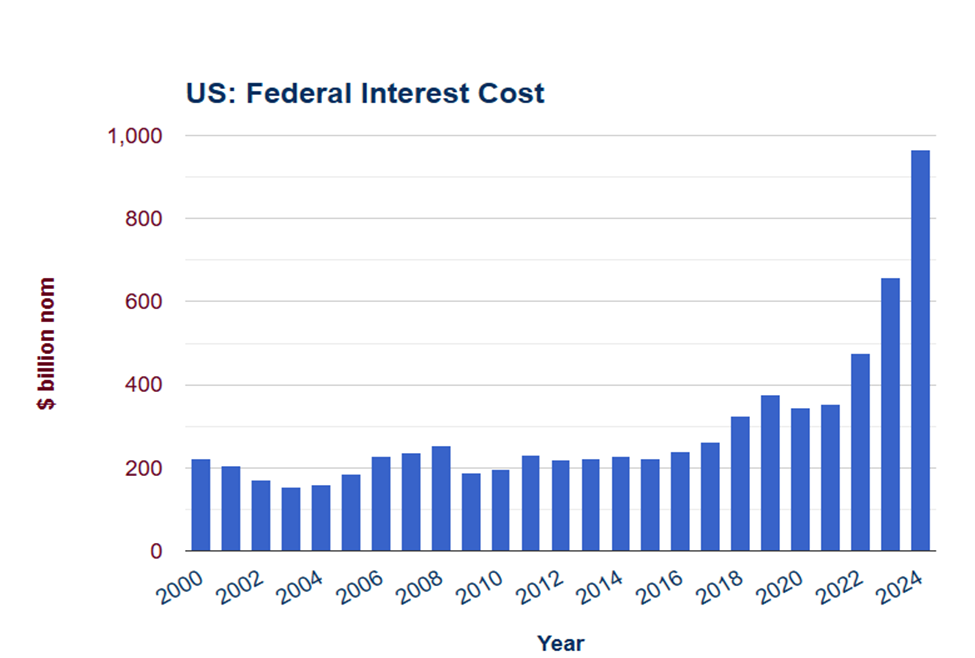

Each year the federal government must spend a sizable amount to cover the interest cost on the National Debt. Let’s go back to 2000, and I’ll show you some eye-popping numbers in recent years.

As you can see, the interest cost in 2023 was $658 billion, and the interest cost in 2024 was a staggering $966 billion. The interest cost in 2023 represented 10.7% of total federal spending for that year. And for 2024, the interest cost was 14.7% of all spending. Let that sink in. A full one-seventh of federal spending goes to covering the expense of interest on the National Debt.

As much as we average Americans might want to cheer on tax relief, it makes no sense for it to come at the expense of further ballooning the National Debt. The simple truth is that tax cuts will significantly reduce federal revenues at a time when we are already spending substantially more than we are taking in. And one-seventh of that spending doesn’t provide the American people with any goods or services. It just covers interest on the National Debt. Paying for a set of tax cuts through deficit financing is “robbing Peter to pay Paul.”

The bottom line: unless huge cuts in federal spending are actually adopted, and additional new federal revenue is created, it will be virtually impossible to adopt most of Trump’s proposed tax cuts without further ballooning the National Debt.

I expect that most of you who voted for Trump aren’t ready to accept the notion that he won’t keep most of his promises to reduce taxes. You’ll want to hold out to see if Trump and the Republicans can enact major reductions in federal spending. You’ll also want to hold out to see if tariffs bring in essential new revenue. This is fine; it’s valid to hold off on adopting tax cuts until we have major spending cuts and tariff revenue coming in. But what’s not fine is to adopt tax cuts when we haven’t actually cut federal spending and we don’t yet have a new source of revenue coming in. We’re not going to go down the road of funding tax cuts through deficit financing.

From my perspective, and I know you probably don’t share it, I don’t see major reductions in federal spending happening. I also see tariffs as “iffy” and unpredictable, and believe Trump will receive lots of pushback, including from members of his own party and the business sector. I expect Trump and the Republicans will again push the “trickle-down theory” to argue that new revenue will be generated because of the tax cuts. I can see Republicans again riding this horse to force a “reconciliation” tax reform (simple majority vote) down the throats of Democrats. On the other hand, there are many Republican “deficit hawks,” and just a handful could jeopardize passage of the cuts.

Let’s assume Trump is successful in getting all Republicans to vote for the package. History says the tax cuts won’t pay for themselves. Ultimately, we’ll have larger deficits, and the National Debt will become even more obscene. This is not a win for the American people.

While Trump and Congressional Republicans oppose raising taxes on rich Americans and corporations, the American people, including a large share of Republicans, favor this option.

A recent survey by the Public Religion Research Institute (PRRI) found that nearly seven in ten Americans (68%) favor increasing taxes on wealthy people and corporations. This includes 92% of Democrats, 69% of Independents, and 46% of Republicans. And a YouGov analysis published in August 2024, itemizes tax policies that Democrats and Republicans support. One such policy was that 86% of Democrats and 55% of Republicans favor increasing taxes on families making over $1 million per year.

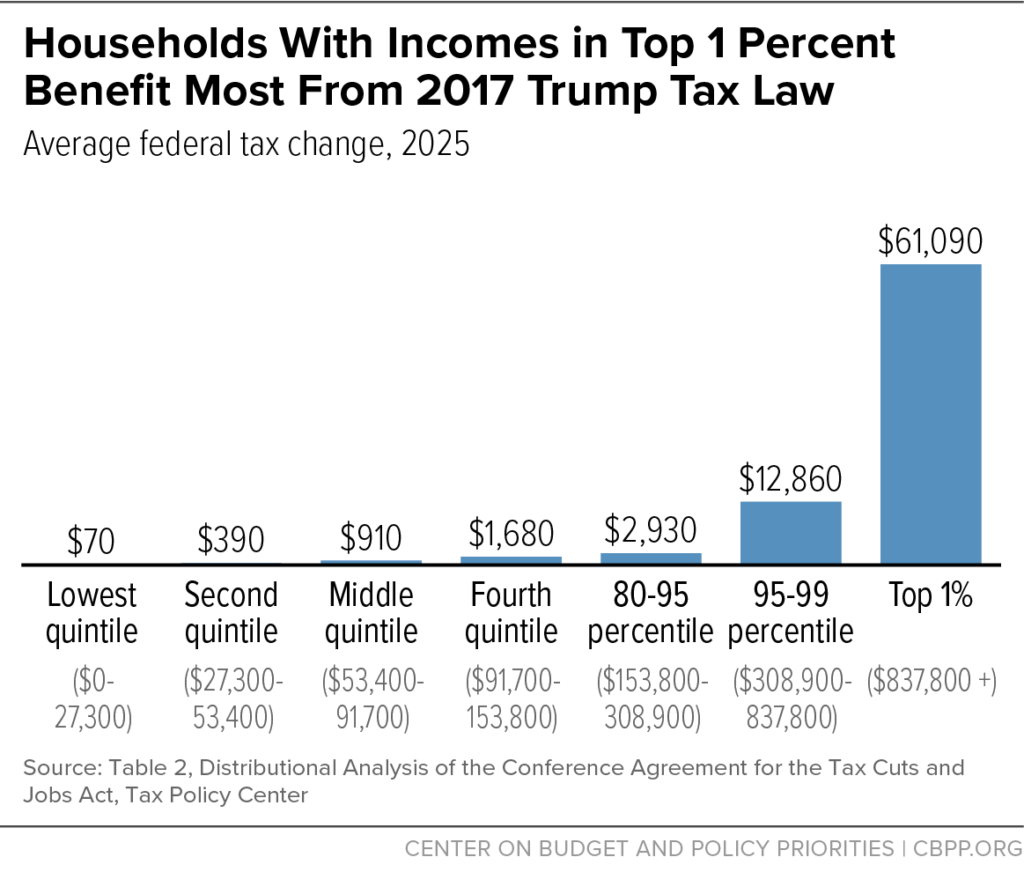

The evidence from the past several decades is overwhelming. In America, the rich are getting richer, and so are corporations. Numerous “trickle down” tax reforms have been passed by Republicans that have done virtually nothing to arrest the growing income inequality faced by the vast majority of Americans. I know you don’t want to hear this, but the Republican party has been captured by the very wealthy and corporations. They will give us—the vast majority of Americans—a pittance of a tax break while they take the lion’s share for themselves. If you don’t believe me, just look at the $61,090 tax break the top 1% got compared with the $910 tax break those earning between $53,400 to $91,700 received.

We can come together on a package of tax cuts that gives the lion’s share of tax relief to the vast majority of Americans who aren’t rich. Let’s tax the very rich and corporations so that we actually have new revenue to pay for the cuts we receive. In so doing, we can enact many of Trump’s tax cuts aimed at us, the vast majority of Americans, without ballooning the National Debt.

Leave a Reply