Among other promises, President Trump campaigned on a trio of commitments to give taxpayers a government that served them better and took less of their money. First, he promised to slash out-of-control spending and overreach by the federal government. He promised to eliminate waste, fraud, and corruption. He promised to act quickly and decisively, in large part through his “Department of Government Efficiency” (DOGE), headed by Elon Musk. Musk even said he could produce at least $2 trillion in cuts.

Second, Trump promised to renew and extend tax cuts to the American people, thus providing a boost to our personal finances. The current framework adopted by the House of Representatives is a step in that direction and envisions $4.5 trillion in tax relief.

And, third, with his proposed system of tariffs, the President promised to collect huge amounts of new revenue that will help pay for his tax cut package and help pay down the country’s massive $36 trillion National Debt. In addition, tariffs will level the playing field with countries that have taken advantage of our trade policies.

This three-part package, taken at face value, seems unassailable as the best outcome for the country and our pocketbooks. By slashing government, our taxes can be lowered and we’ll get the government off our backs. Tariffs will put even more revenue into federal coffers, not only covering the cost of the tax cuts, but also enabling the government to pay down its obscene National Debt. The country will be far better off, and each of us individually will smiling all the way to the bank.

Before we celebrate, we need to take a moment to validate the President’s promises as well as the talking points he and Republicans are using to support their case. Put simply, while Trump’s tax cuts will allow us to keep more of our earnings, we are going to be digging into our wallets to pay for the increased cost of products that are tariffed. And, especially the poorest among us, will be digging into our wallets to make up for the loss of government subsidies that Trump and the Republicans slash or eliminate. Indeed, when we conduct an objective analysis, there is every reason to believe that the vast majority of Americans will end up worse financially.

I know most you you may be shaking your head. But let’s drill down and see if my conclusion is supported.

As to the currently-proposed $4.5 trillion tax cut package, the framework passed by the House of Representatives requires $2 trillion in spending reductions, permits annual deficits to increase by nearly $3.3 trillion, raises the debt limit by $4 trillion, and relies on unrealistic projections regarding the positive economic effects the tax cuts will have on deficit reduction.

The House of Representatives recently passed a framework for a $4.5 trillion package of tax cuts that it claims is fiscally responsible and beneficial for Americans and the economy. Let’s take a look.

First, the tax cuts obviously don’t pay for themselves. A portion of the package will be funded by spending cuts, as noted above. But the lion’s share will be financed by spending far more than we are taking in. Over a ten-year period, budget deficits will be allowed to increase by just short of $3.3 trillion. These annual deficit increases will drive up the cumulative National Debt. Accordingly, the House proposal calls for increasing the nation’s debt limit by $4 trillion in just the next two years.

Second, the numbers in the House’s framework rely on unrealistic assumptions regarding the effect the tax cuts will have on the economy and deficit reduction. Unlike estimates from the Congressional Budget Office (CBO), the House framework projects the tax cuts will spur huge growth in the economy. Its assumption is ”that the economy will grow more than 40 percent faster each year over the coming decade than the Congressional Budget Office (CBO) projects, yielding a ten-year “economic bonus” that would reduce the projected deficit by $2.6 trillion.”

This “economic bonus” is simply not credible. CBO projects that economic growth, adjusted for inflation, will average around 1.8% from 2026 to 2035. The House estimate is 2.6% per year. This estimate has been dubbed, “fantasy math” by the Committee for a Responsible Federal Budget. Models by several prominent organizations and think tanks are much closer to the CBO analysis.

Third, the $4.5 trillion figure adopted by the House doesn’t come close to paying for all of the tax cuts Trump promised on the campaign trail. Congress will be left with deciding the specific cuts to keep within this figure. However, if Congress makes more that $2 trillion in spending reductions, the difference will be added to the $4.5 trillion authorizations. Thus, $3 trillion in spending cuts would allow for a $5.5 trillion tax package. On the other hand, if spending reductions are less than $2 trillion, the shortage will be deducted from the $4.5 trillion figure. Thus, only $1.5 trillion in spending cuts would only allow for a $4 trillion tax cut package.

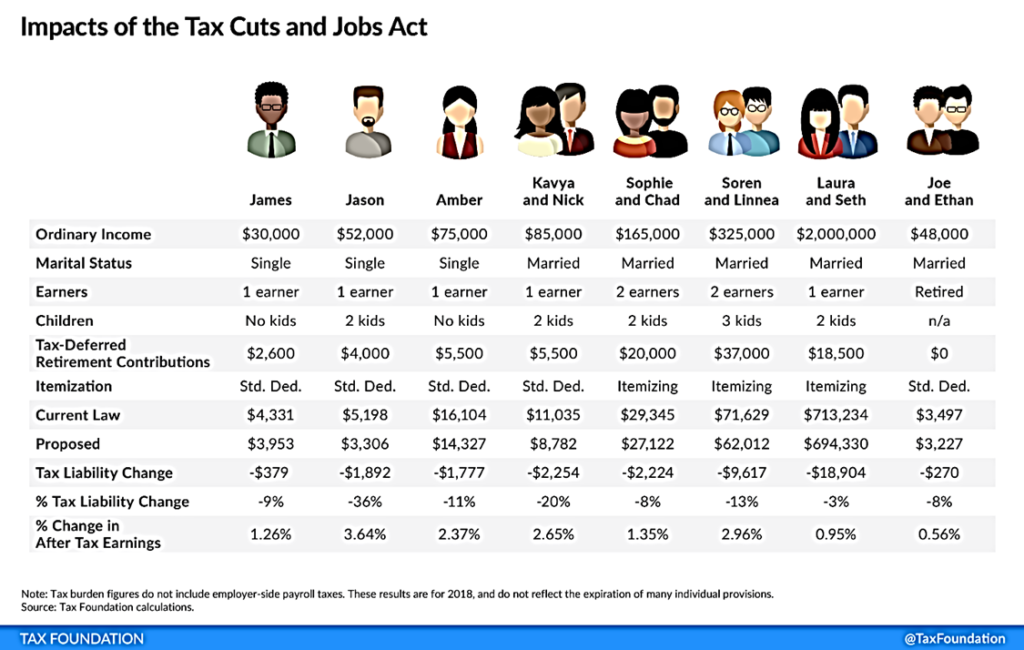

About half of the cost of extending the expiring provisions of the Tax Cut and Jobs Act is required to maintain tax breaks for the wealthiest 5% of households; whereas the vast majority of taxpayers will only see tax breaks in the range of $70 to $1,700 per year.

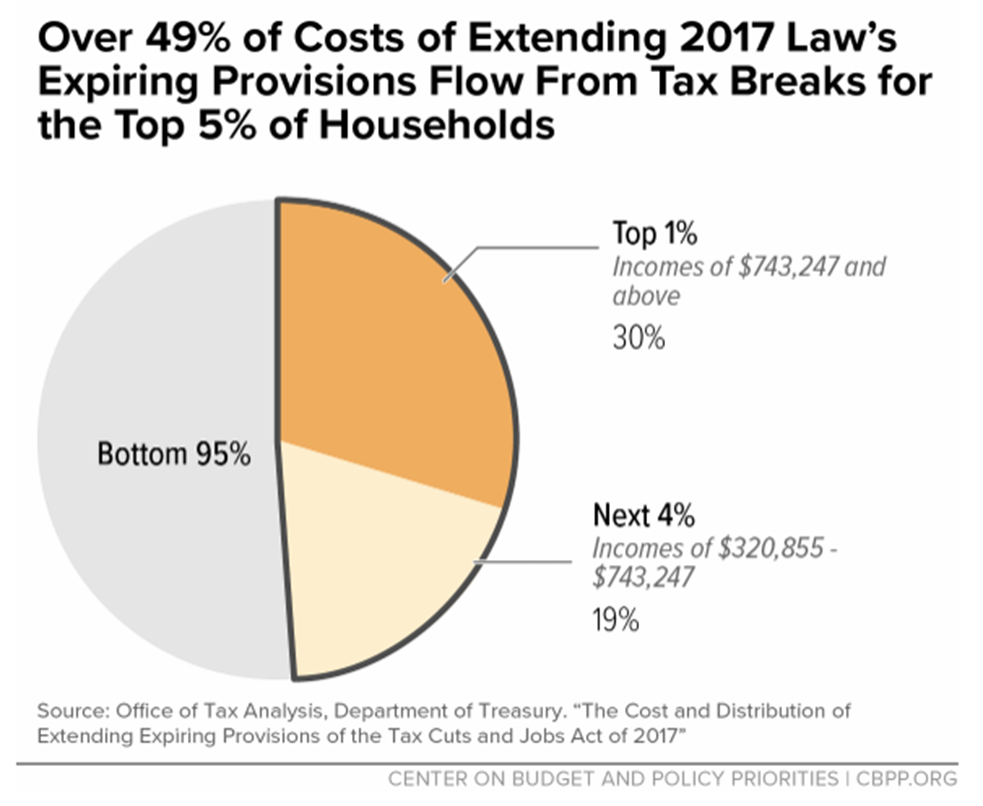

According to the Center on Budget and Policy Priorities, extending the tax cuts for the top 1 percent (households with more than $743,000 per year) costs $1.1 trillion through 2034. Also according to the Center on Budget and Policy Priorities, extending the expiring tax provisions for households with incomes in the top 5 percent (households with incomes over $321,000) costs around $1.8 trillion through 2034. This accounts for 49 percent of the total $3.6 trillion cost of extension through 2034 (see graph below).

The US Treasury largely agrees with this analysis and concludes the cost of extending the tax cuts would be more than cut in half if cuts for the rich and corporations were allowed to expire. Here is its conclusion:

“Extending the expiring individual and estate tax provisions of the TCJA would cost $4.2 trillion between 2026 and 2035. . . . Reversing TCJA tax cuts for those with incomes above $400,000 and allowing the business and estate tax cuts to expire as scheduled under current law would reduce the cost of extending expiring TCJA provisions to $1.8 trillion, or less than half the cost of extending all of the individual and estate tax cuts and about a third of the total cost including business provisions.”

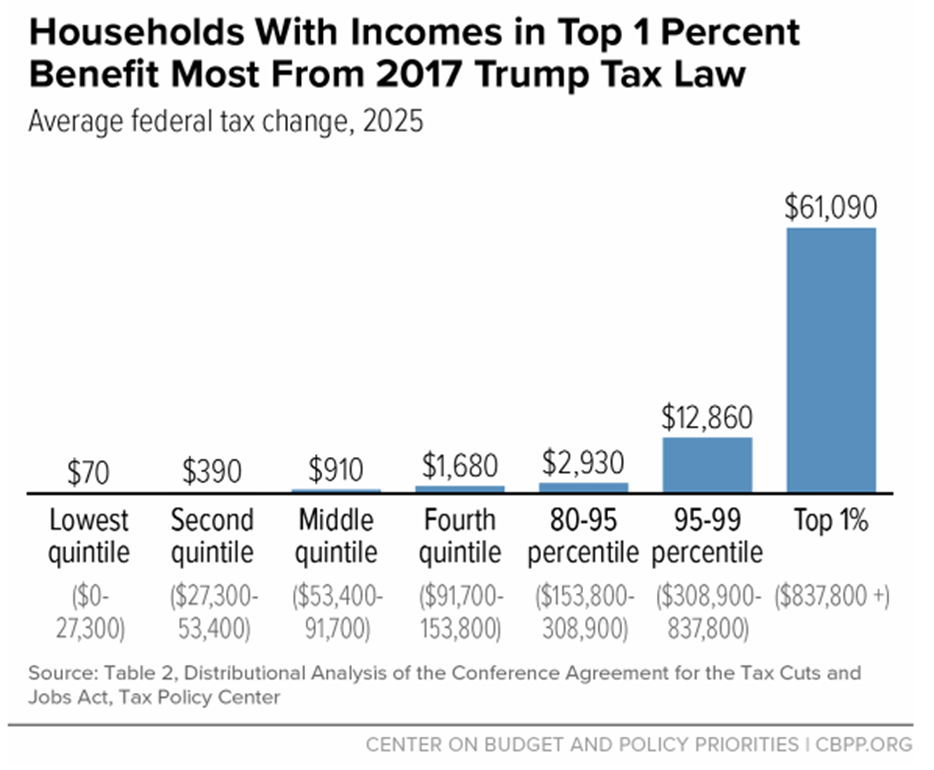

Including the rich in extending the tax cuts is clearly very expensive. However, when it comes to receiving the benefits of the tax cuts, most taxpayers will receive a pittance. The two charts below show that the wealthiest individuals will receive the biggest tax cuts by far ($12,860 to $61,090), while the other 95% of taxpayers will receive less than $2,500 per year. The exact amount of tax relief based on income level cannot, of course, be determined until Congress decides the details of the tax package.

While 95% of taxpayers will receive tax savings in the range of hundreds to a few thousand dollars a year, they will have to dig into their wallets to pay for the increased costs of goods that are subject to Trump’s tariffs.

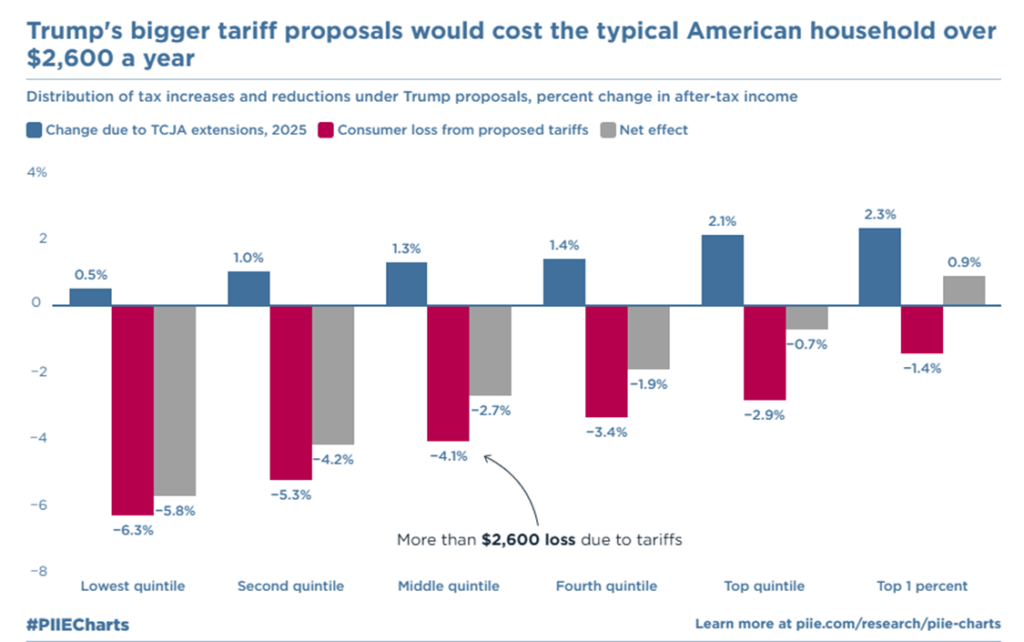

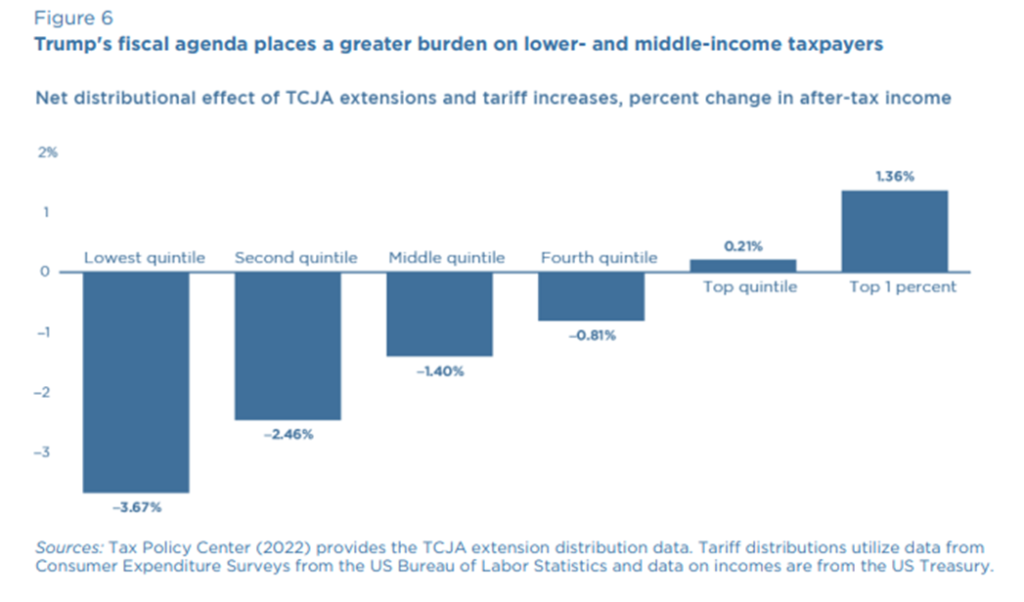

The Peterson Institute for International Economics released an analysis entitled, “Trump’s bigger tariff proposals would cost the typical American household over $2,600 a year.” Those at the bottom of the income scale would see the biggest percentage losses in income after tariffs, as seen by the chart below.

The Peterson Institute also concludes that, even with the benefit of the tax cut, the effect of tariffs will have the most negative effects on after tax income of poor and middle class taxpayers (see below).

Finally, the Tax Foundation concludes that Trump’s proposed tariffs will reduce after-tax incomes by an average of 1.7 Percent.

Again, because Trump has paused and reconfigured his schedule of tariffs on multiple occasions, it is not yet possible to determine precisely how much taxpayers will have to come out of pocket. We do know, however, that each day he delays a tariff, or each tariff he reduces, will result in less revenue generated for the federal government. This loss of revenue will make it harder to pay for the tax package, reduce deficits, and pay down the National Debt.

Taxpayers—particularly the poor, elderly, and disabled who receive government services and subsidies—will have to dig into their wallets or fend for themselves if their services and subsidies are slashed in order to come up with $2 trillion in cuts.

As to the $2 trillion in spending reductions, the House framework does not specify particular programs to be cut. Rather, it identifies various House Committees and assigns dollar amounts of savings each is to achieve. By knowing which federal programs are assigned to which committees, we can discern the programs that stand to be affected.

The lion’s share of spending reductions are assigned to just three committees. The Energy and Commerce Committee is to come up with $880 billion in spending reductions. Its jurisdiction includes Medicare and Medicaid. The Education and Workforce Committee is to come up with $330 billion in cuts, and its jurisdiction includes student loan programs. Finally, the Agriculture Committee must come up with $230 billion in cuts, and its jurisdiction includes the Supplemental Nutrition Assistance Program (SNAP, or food stamps).

As the legislation is put together, the specific cuts to specific programs will be identified. However, it is virtually certain that the programs being targeted are Medicaid, SNAP, and student loan programs. These programs primarily serve individuals who are poor, elderly, and/or disabled. Republicans assert they will only be cutting waste, fraud, and abuse. Democrats counter that achieving the targets for each committee will be impossible without deep program cuts.

Let’s drill down a bit to see what’s involved, especially with Medicaid and SNAP.

Some 79 million people are enrolled in Medicaid and its related Children’s Health Insurance Program (CHIP). Medicaid covers nearly half of all US children. This includes over 40% of births, including nearly 50% of births in rural communities. It also includes many low-income elderly and disabled individuals, as well as working adults in low-wage jobs that do not offer affordable coverage. Medicaid pays for care costs for more than 60% of nursing home residents.

Medicaid operates as a state-federal partnership, with the federal government paying most of the money (about $600 billion annually) and matching state funds regardless of how many people enroll. Most Americans, including 64% of Republicans, have positive views about Medicaid and think it works well for low income people.

Republicans will face resistance within their own ranks if they decide to make major Medicaid cuts. The effects could be especially harsh in rural areas with high percentages of poor or elderly individuals. Hospitals have benefited from increased enrollment in health insurance programs such as Medicaid because it guarantees payment for a patient’s treatment.

Members are likely to be hesitant to cut Medicaid if they are convinced it could lead to hospital closures in their districts. Notes the American Hospital Association:

“Today, hospitals that serve disproportionately high rates of Medicaid and other public-payer patients routinely operate with negative margins and are often forced to terminate service lines or close entirely. Reductions in federal support for Medicaid would exacerbate these pressures, which could strip essential health care services for an entire community.”

In FY 2023, SNAP served 42 million participants, or about 12.6% of the US population. The largest share of participants are children and adults aged 18-59, but the elderly make up almost one-fifth of recipients (see graph below)

Federal SNAP spending totaled $112.8 billion; and benefits averaged $211.93 per participant per month. About 92 percent of all SNAP benefits go to households with income at or below the federal poverty line. About 37% of SNAP participants are White, 26% are African American, 16% are Hispanic, 3% are Asian, and 2% are Native American. Race is not known for 16% of recipients.

Given the demographics of participants, 6 of the 10 states with the highest percentage of SNAP recipients are Republican (Red) states, including: Louisiana (19.5%), West Virginia (18.2%), Oklahoma (17.2%), Alabama (15.4%), Nevada (15.0%), and North Carolina (15.0%).

The Economic Policy Institute analyzed the House’s framework for $2 trillion in cuts and concludes it will be devastating for lower income households:

“If tax cuts for the rich are financed by large cuts in federal spending, this would greatly damage current incomes and future opportunities for the most vulnerable families in the U.S. The bottom 20% of households would lose 7.4% of income due to the Medicaid cuts that would be enabled by this budget resolution, and would gain only 0.6% of income from an extension of the Tax Cuts & Jobs Act . . . “ (emphasis added).

When all is said and done, if the committee targets are to be reached, the reality is that there will be deep cuts to Medicaid and SNAP. A recent analysis by the Congressional Budget Office confirms this conclusion as to Medicaid. America’s poor, elderly, and disabled, as well as their children, will end up far worse off than if their Medicaid and SNAP subsidies remained intact.

DOGE and Elon Musk will not be able to cut anything remotely close to $2 trillion in federal spending; and the amount of savings actually achieved via DOGE is likely to be a tiny fraction of this amount.

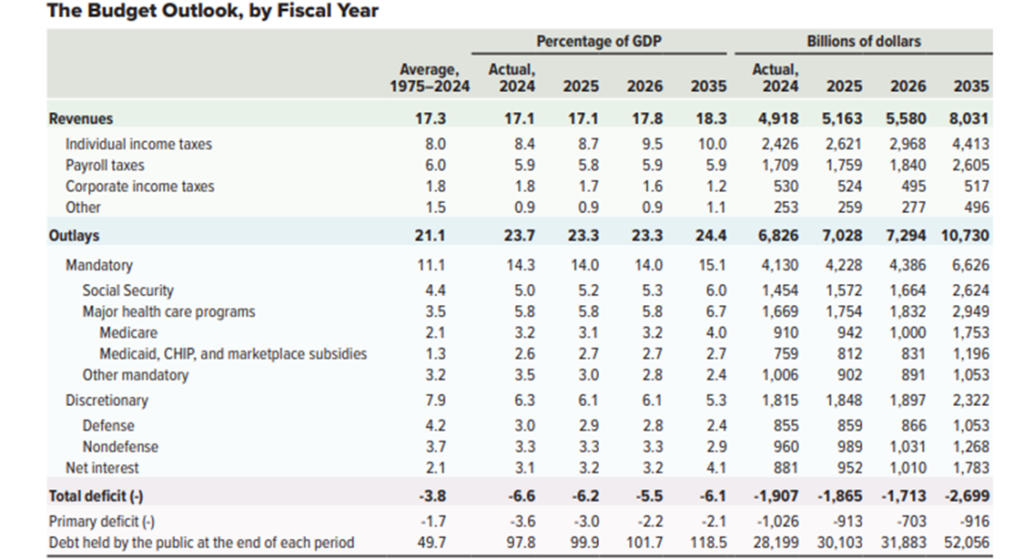

Here’s the simple math. Total federal spending for fiscal year 2025 is $7.028 trillion. Thus, a $2 trillion reduction would require cutting more than 28% of all spending. Is there really that much waste, fraud, and abuse? Let’s take a look.

If you examine the chart below, under “Outlays” you’ll see that it’s broken down into three categories: Mandatory, Discretionary, and Net Interest (interest payments on our debt). For 2025, there’s $4.228 trillion in Mandatory spending for such programs as Social Security, Medicare, Medicaid, and other programs. Then, if you look at Discretionary spending, you’ll see that $859 billion is for defense, and $1.03 trillion is for “nondefense.” Finally, you’ll see that $952 billion is required to pay interest on our National Debt.

Obviously, we have no choice but to pay interest on our debt. As to Mandatory spending, President Trump promised multiple times to protect Social Security, Medicare, and Medicaid. As to Discretionary spending, Republicans currently have plans to increase defense spending. These commitments take the lion’s share of spending for these programs off the table. The exception is that if some of the spending can be shown as waste, fraud, or abuse. DOGE would need to identify and document its findings and reasoning.

However, let us remember that any savings created by DOGE can be allocated to pay for the tax cuts, pay down the National Debt, or provide a “DOGE Dividend” to taxpayers. If DOGE and Congress identify the same item of waste—say, for instance, cutting $50 billion from Medicaid—if Congress decides to include this cut in its tax package the savings will no longer be available for reducing the National Debt or providing a DOGE dividend. Similarly, if a DOGE dividend is given to taxpayers, the money spent on the dividend will no longer be available for the tax package or paying down the National Debt. Effectively, this means DOGE’s main task is to identify and create savings. It will be the job of Congress and the President to decide how these savings are allocated.

Congress is focusing on cuts to Mandatory spending in its tax package, and it will control those cuts. Thus, the stream of spending that DOGE and Musk are concentrating on is “Nondefense Discretionary” (NDD), which is at $989 billion. The NDD funding stream covers a host of federal agencies and their employees. It also covers grants, contracts, and other aid administered by these agencies.

Obviously, as brilliant as Musk is, he cannot cut $2 trillion from $989 billion. It’s also important to note that NDD spending has not been increasing nearly as much as Mandatory spending over the past several decades. There may not be as much waste and fat as Trump and Musk allege.

DOGE’s case for cutting federal spending relies on unsubstantiated generalities, exaggerated dollar amounts, and contrived egregious examples.

Trump, Musk, Press Secretary Karoline Leavitt, Republicans, and the conservative media regularly cite examples of outrageous spending. For instance, $50 million in USAID funds was supposedly sent to Gaza to provide condoms for Hamas. This statement is simply false. Trump also said on Truth Social that billions of dollars had been stolen at USAID, and other agencies and given “to the fake news media” to write favorable stories about Democrats. Again, this statement is false. In another instance, Musk, Leavitt and others assert massive fraud and incompetence because tens of millions of dead people over 100 years old are receiving Social Security checks. This claim has been debunked.

More often, Trump, Musk, and the Administration simply claim there is government fraud without providing evidence or proof. They use these assertions to justify their statements that fraud and waste is in the hundreds of billions of dollars. And they go on Fox News (e.g., Hannity) to repeat these generalizations and assert that the voters get it.

Meanwhile, DOGE’s actions and spending cuts thus far are overstated, unpopular with the American public, and potentially threatening to public safety and national interests.

As of March 10, the official DOGE Website states that DOGE’s total estimated savings are $105 billion. Politico, NPR, ABC News and other media outlets are critical of DOGE’s findings. The stories document how the cuts “don’t add up,” “are hard to verify,” and “don’t match.” For instance, an $8 million cancelled contract was listed as $8 billion. Also, when the totals listed on the website were added up, $85 billion of the savings had no specifically documented source.

In addition, when it comes to staffing reductions, there are at least two problems. First, the American people don’t support the mass firings. And second, the reductions could threaten public safety and national interests.. In a February 16-18 Economist/YouGov Poll (see list of Tables, tab 38J), only 34% of Americans supported the firing of hundreds of thousands of federal workers. In fact, 51% opposed this action. While 63% of Republicans supported the mass firings, 53% of Independents and 81% of Democrats opposed.

When we examine the rapid and haphazard manner in which staff reductions are being carried out we can see why public opinion is disapproving.

As of February 24, AP estimates that some 220,000 federal workers on probationary status have been fired since January, and that another 75,000 probationary employees have accepted a buyout plan known as “deferred resignation.” In essence, because these “probationary status” employees don’t have the full due process rights of regular employees, they can be fired based on a simple written reason.

Here are some of those reasons:

- You did not accept the deferred termination package

- The agency finds, based on your performance, that you have not demonstrated that your further employment at the agency would be in the public interest.

- Your position is not “mission critical” to the agency

- You are being terminated due to the workforce optimization executive order, signed by Trump on Tuesday, that promised a “critical transformation of the Federal bureaucracy” aimed at “eliminating waste”

- We’ve been directed by the administration to remove all probationary employees

Most of those terminated were given no notice and given a short period of time—like a day or a few hours—to leave. Many of these probationary employees had excellent performance evaluations. And many others had been federal employees for years, recently moving from a position with civil service protections to a promotion in probationary status.

Acting with such haste, DOGE has reversed itself on some of the mass firings, including workers who oversee nuclear weapons, FDA medical device reviewers and food safety reviewers, National Park Service staff, and Department of Agriculture staff working on bird flu.

In the big picture, it’s hard to imagine that a 10% reduction to the current federal workforce of 2.4 million employees (excluding military and postal service) could be pulled off without some negative outcomes or unanticipated problems. For instance, the IRS is laying off thousands of employees in the middle of tax season. What will this mean in terms of processing refunds or auditing tax returns?

Finally, we should consider whether the gamble is worth the anticipated savings. The federal government spends approximately $350 billion per year on its employees. Reducing the workforce by 10% would yield $35 billion per year in savings, less than a half of 1% of federal spending in 2025.

For about 95% of taxpayers, the savings they gain from their tax cuts will most probably be erased by the costs of tariffs and the subsidies they lose (e.g., Medicaid, SNAP, and student loan relief) because of $2 trillion in reductions to federal spending.

There is no way of sugarcoating it. Passing a tax cut package to replace the expiring Tax Cut and Jobs Act is going to cost at least $4.5 trillion at a time when the current year’s Budget deficit is $1.8 trillion, and the National Debt is $36 trillion. For Republicans to at least argue it’s possible to adopt tax cuts and still achieve a balanced budget, it’s necessary to make huge cuts in federal spending, bring in massive new revenue via tariffs, and assume that the tax cuts will spur huge economic growth that produces more federal revenue.

At this point in time, many of the proposed tariffs have been delayed or reconfigured. Actual collections are running far behind what Trump bragged about. It is not yet possible to reliably project revenues given his daily changing actions.

Also at this point in time, we don’t know whether DOGE will produce billions, hundreds of billions, or possibly even more in savings. DOGE’s claims of savings need to be verified and legal challenges to its actions need to play out. Once actual savings are known, decisions will be made whether the savings go the paying for the tax cuts, paying down the National Debt, or returned to taxpayers in the form of a DOGE dividend. Given the priorities of funding the tax cut and paying down the National Debt, the prospect of a DOGE Dividend must be considered remote. It’s largely a PR ploy to get voters to support DOGE and think Trump is fighting for them. It is also inflationary.

Finally, we do know the impact will be devastating if huge cuts are made to programs that serve the poor, elderly, disabled, and the young. They will either have to go without services and subsidies or dig into their wallets and pay for the subsidies and services themselves. For these populations, they will certainly be worse off than in prior years.

On the other hand, taxpayers in the top 5% will retain hefty tax savings and not be affected by huge cuts to programs for the poor and middle class. Their tax breaks will more than cover what they pay in increased costs due to tariffs.

The plight of all taxpayers could actually worsen if the country falls into recession, high unemployment, or increased inflation due to the destabilizing effects of tariffs and massive cuts in federal spending.

In the coming months we need to keep an eye on GDP growth, monthly jobs reports, and inflation numbers. Massive cuts to federal spending will result in hundreds of thousands of government employees being out of work and not paying taxes. The loss of tax revenue could lead to deficits. It remains to be seen how much tariffs will affect the costs of goods and services (i.e., inflation). Also, massive cuts in federal spending will surely have an effect on GDP growth, possibly leading to recession. Worse, some economists see stagflation in 2025, where we would experience high inflation with flat economic growth.

This is not what Trump promised Americans when he was on the campaign trail. We were promised the greatest economy and prosperity ever. Should any of these negative conditions surface, his attempts to explain them away should be rejected along with the broken promises he made on the campaign trail.

Here’s a far better way to give the vast majority of Americans a tax cut and a streamlined federal government: 1) Renew the Tax Cut and Jobs Act (TCJA) for all income brackets except wealthy taxpayers; 2) Continue efforts to identify, document, and eliminate waste and fraud in federal government; and 3) Abandon widespread tariffs and deep cuts to federal programs that go beyond eliminating waste and fraud.

Renewing the TCJA becomes a lot less expensive—by trillions—if tax cuts for the wealthiest Americas are allowed to expire. Having DOGE and Congress continue their efforts to identify and eliminate waste and fraud can make government more efficient and accountable. But the process needs to be deliberate, with waste and fraud documented. Congress also needs to be involved because of its Constitutional role in controlling the purse strings.

Abandoning widespread tariffs and deep cuts to programs that provide subsidies and services to a large percentage of Americans will ensure the vast majority of Americans actually benefit from their tax cuts. The prospect of widespread tariffs has been destabilizing not only for the economy, but also the stock market. The last thing we need is to fall into recession or have a new bout of high inflation.

The wealthiest 5% of Americans will easily survive if their tax breaks sunset at the end of this year. If we go back to Barack Obama’s second term (2013-2016), we’ll find that wealthy taxpayers were doing quite well without the tax cut they later received via the TCJA in 2017. The economy was strong, with solid GDP growth, strong job numbers, and low inflation. Unemployment was low, as were interest rates. Annual deficits and the national debt were growing, but not as fast since the Covid-19 pandemic starting in 2020. Moreover, America’s rich have enjoyed increasing income inequality going back decades. For once, they need to take a back seat.

Leave a Reply