Federal tax policy and the procedural workings of Congress are two of the most complex and difficult political topics in America. Both of these subjects are technical labyrinths, complete with their own jargon. They are now before the American people, of course, because of Trump’s promise to renew and revise his 2017 tax reform, the Tax Cut and Jobs Act.

To provide a sobering example, how many of you understand this recent update from the Tax Foundation, which is quoted below:

- Lawmakers will use the budget reconciliation process to enact new tax cuts. Reconciliation is a fast-track option that overcomes the Senate filibuster and can be used to enact tax, spending, and debt limit changes outlined in a budget resolution with specified targets or limits for deficit changes within the budget window.

- On February 25, 2025, the House passed a budget resolution to start the reconciliation process, specifying reductions in taxes and spending over the next decade relative to a current law baseline. The House budget resolution allows a $4.5 trillion increase in the deficit from tax cuts over the next decade so long as spending is cut by $1.7 trillion. If spending is not cut by $1.7 trillion, the cap on tax cuts will be reduced dollar-for-dollar; if spending is cut by more than $1.7 trillion, the cap on tax cuts will be increased by the same.

- On April 2, 2025, the Senate introduced an updated budget resolution to provide new guidance to its committees on tax and spending policy changes. It adopts the instructions in the House resolution for the House committees while instructing the Senate Finance Committee to make tax policy changes that reduce revenue by up to $1.5 trillion over 10 years against a current policy baseline, which assumes an additional $3.8 trillion in tax cuts. While the $3.8 trillion would not officially score as a deficit increase against a current policy baseline, it effectively permits $5.3 trillion in deficit-financed tax cuts.

And this summary doesn’t even mention such additional issues such as compliance the “Byrd Rule” in the application of reconciliation, use of “static” versus “dynamic” revenue analysis, and rulings of the Senate Parliamentarian (including when and how they can be ignored).

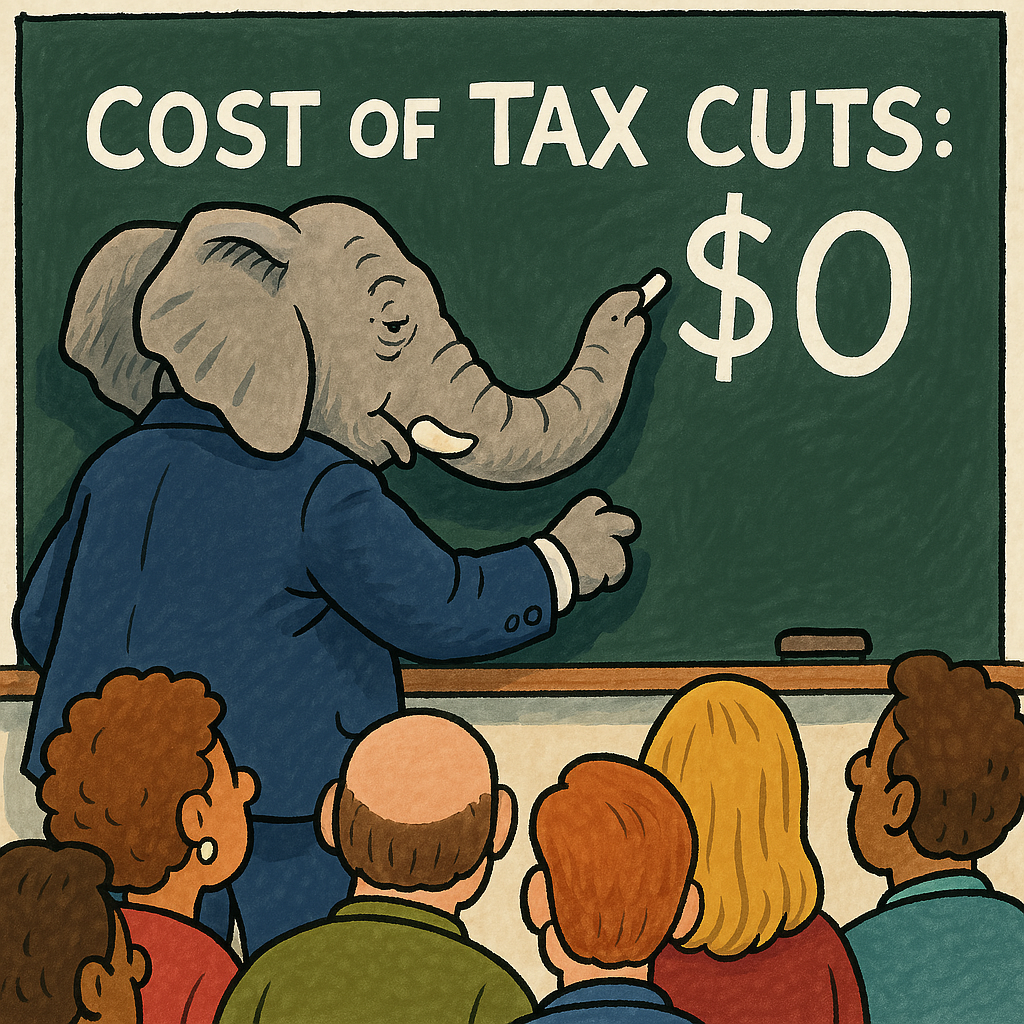

Unless you’re a technical expert on federal taxes and Congress, you’re throwing up your hands when it comes to understanding the current status of the tax package. This, unfortunately, is a problem for two reasons. First, procedural maneuvers and potential rules violations are being used to obscure the true costs or fiscal impact of the tax package. And, second, the complexities of the subject matter afford Republicans an opportunity to “explain” the merits of their legislation in a manner that is deceptive or just plain wrong.

At this stage of the tax package, I see clear evidence of both problems. In this article I’ll attempt to break through the complexities, technical talk, and jargon to explain why the proposal being developed will increase rather than reduce annual deficits and the National Debt. Republicans know this to be the case and could vastly reduce the costs of the tax package by not renewing tax cuts for wealthy Americans. A wide majority of Americans favor this option. But Republicans will either resort to fiction about reducing the National Debt or cut spending so heavily that only the wealthy emerge unscathed.

Adopting the “current policy” approach instead of the established “current law” method allows Republicans to hide the actual costs of renewing the tax cuts.

The Tax Cut and Jobs Act of 2017 was adopted with most of its tax cuts set to expire on December 31, 2025. If new legislation is not enacted by that time, the tax cuts will expire, and we’ll go back to tax rates under previous law. Obviously, if we go back to higher tax rates, the government will be collecting more taxes, and federal revenue will go up. This can help with reducing deficits and the National Debt.

On the other hand, what happens if we decide to renew or extend the tax cuts? Historically, we have applied the “current law” approach. This means that we calculate the fiscal effects based on the assumption that the law expires. Thus, extending tax cuts beyond December 31, 2025, involves new costs to the federal government. Put simply, instead of collecting more revenue, we’ll collect less because we chose to extend the tax cuts.

However, in a major departure from this historical practice, Republicans in control of the Senate chose to take a “current policy” approach in developing their proposal. This approach takes the position that tax cuts with a scheduled expiration date are assumed to continue. The effect is to vastly reduce the deficit impact for the extension because we assume the current cuts will continue and are already paid for.

To enable the “current policy” approach, Republicans authorized the Senate Budget Committee to create its own cost estimate, instead of relying on official scores from the Congressional Budget Office and the Joint Committee on Taxation. Doing so could eventually break multiple Senate rules, a matter to be decided by the Parliamentarian.

To give you an idea of the actual numbers, the Senate assumes that extending the current tax cuts costs $3.8 trillion, and that under the “current policy” approach this involves zero new cost. The Senate’s version goes on to put $1.5 trillion towards the tax cuts, meaning that is the only new cost that needs to be considered. But, in actuality, this gives $5.3 trillion of room to construct tax cuts ($3.8 trillion + $1.5 trillion). The $3.8 trillion for extending the current tax cuts is not scored as driving up deficits. Democrats are slamming this as “magic math.”

Tellingly, the Senate proposal includes a $5 trillion Debt Limit increase, meaning it recognizes that the National Debt will, in fact, go up substantially.

Regardless of which approach is used, neither changes the reality of the current National Debt and annual deficits of $2 trillion; and extending the tax cuts without offsetting cuts will lead to much higher deficits.

Concludes the Bipartisan Policy Center, “One baseline can show a bill to cost $4.5 trillion on paper and another $0, but—compared to the letter of the law—extending expiring TCJA provisions without offsets will contribute $4.5 trillion to deficits.”

In developing its tax proposal blueprint, the House of Representatives owned the fact that extending the current tax cuts and adding others would drive up deficits and the National Debt. It thus used the “current law” approach; and to accommodate, the House called for at least $1.7 trillion in spending cuts.

Regardless of which approach is used, Republicans are moving to either adopt a tax cut package that seriously drives up annual deficits and the National Debt, or a package that makes drastic spending cuts that deny services and support for low and middle income Americans.

The “current policy” approach is a sham. It attempts to hide the reality that renewing the tax cuts will drive up deficits and the National Debt. It’s an expedient but hypocritical solution that will save Trump and the Republicans from making deep cuts that will likely have far-reaching political consequences. House Republicans who resist will be pressured and “primaried.” But if they yield, it means that Republicans don’t really care about deficits and the National Debt. It’s all political lip service.

On the other hand, the tax package could play out with huge cuts to programs like Medicaid, SNAPS, student financial aid, and other services. Ironically, programs for the poor and the middle class will be cut in order to pay for extending tax cuts to America’s richest citizens. In neither of the Republican proposals is there any sentiment towards reducing the cost of the tax package by holding off on extending cuts to the wealthy. Doing so could save at least $1.9 trillion.

Trump and Republicans will argue that huge new tariff revenue will pay for the tax cuts and help lower deficits; however, his gamble is threatening the economy, Americans are facing increased costs due to the tariffs, and it’s speculative to project revenues in the ever-changing rollout of policy.

Trump’s “hole card” in the tax package discussion is, of course, tariffs. After a few months of vascillating, Trump announced a comprehensive array of tariffs on April 2. It’s likely the Administration will soon boast about the huge amount of revenue being generated. However, it remains to be seen whether Trump will relax these tariffs, negotiate deals with individual countries, or make other changes. We also don’t know how much Americans are going to be coming out of pocket to pay for costs being passed on to them. And, perhaps most important, Trump’s gamble is threatening the economy. The risk of a recession keeps increasing, the stock market has taken a pounding, and consumer sentiment is plummeting.

My personal prediction is that Trump will use the tariff argument to convince Republican budget hawks in the House that there are substantial new revenues that can be used to reduce deficits and the National Debt. I believe Republicans will be loathe to incur the political consequences of huge cuts to popular federal programs and services. Republicans will instead use the “current policy” approach to hide the impact of the tax cuts on deficits and the National Debt.

And, in my cynical view, not long after securing passage of his tax cuts, Trump will cut deals and declare victory on tariffs. Backing off a bit will stimulate the world economy and US stock market. It will also help reduce costs to consumers. And Republicans will stop talking about deficits and the National Debt.

But all of these maneuvers are sleight of hand tricks that don’t really fix the underlying problems. Even if we’re lucky enough to avoid Trump crashing the economy, we’ll be left with huge deficits and America’s very wealthy will continue to have the upper hand.

Leave a Reply