Part 3 in a series of letters to Trump voters

In voting for Trump, I suspect you believe Republican presidents are better for the stock market than Democrats. Most of you probably remember the Dow Jones Industrial and S&P 500 indexes booming during his first term. In contrast, you probably view the market’s performance as subpar under Biden. I expect you believe the rally right after the election was due to Trump’s win, and that he deserves the credit. I also expect you believe Trump will far outpace any stock market gains that Kamala Harris might have produced.

While I understand that you have these views, I found myself wondering what experts and the research literature have to say about them. Economists tell us that presidents do have a modest degree of influence on the stock market, but larger economic events and factors mostly drive investment. Let me quote a typical assessment:

“While the President can influence the economy through policies and economic agendas that can impact the stock market, the president probably gets too much blame and too much credit when it goes down or up. That’s because larger macro events generally drive investment sentiment over the longer term.”

Investopedia, November 24, 2024

I decided to look into the stock market because on the political side of things we do a lot of blaming and taking credit without really considering the “larger macro events.” When the market goes up, the sitting president invariably takes credit; and when the market goes down, the sitting president and party in control are unfailingly blamed.

During campaign season in election years, candidates especially go crazy assigning credit and blame. The narratives sometimes defy logic. For instance, when Trump won a few primaries in January 2024, he claimed credit for big stock market gains occurring at the time. He argued that because his poll numbers against Biden were so good, he was being projected to win in November, and this was driving the market up. In early August, when the market plunged because of a poor jobs report and the Fed deciding not to lower interest rates, Trump dubbed it a “Kamala Crash” due to her being clueless about stocks. But the market fully rebounded within two weeks.

With this fusillade of blame and credit, tens of millions of us are left in a lather over our 401k’s being decimated by irresponsible presidents driving the economy into the ground. And sitting or former presidents never miss a chance to take credit when the market goes up. Once again, hyper-partisan politics are being used to sew anger and discord for the purpose of winning elections. Do we really need to be divided and angry if what’s mostly causing the ups and downs of the stock market are larger macro events? Let’s dig in and find out.

While it may disappoint you to learn the stock market historically performed the best when Democratic presidents were in office, this does not prove that presidents are the primary cause of the market going up or down.

In the world of politics there is lots of jockeying for position when it comes to stock market performance. Political narratives lead us to that believe presidents should get 100% of the credit when the market goes up, and 100% of the blame when it goes down. This is absurd. But let’s take a moment to see how the game is played.

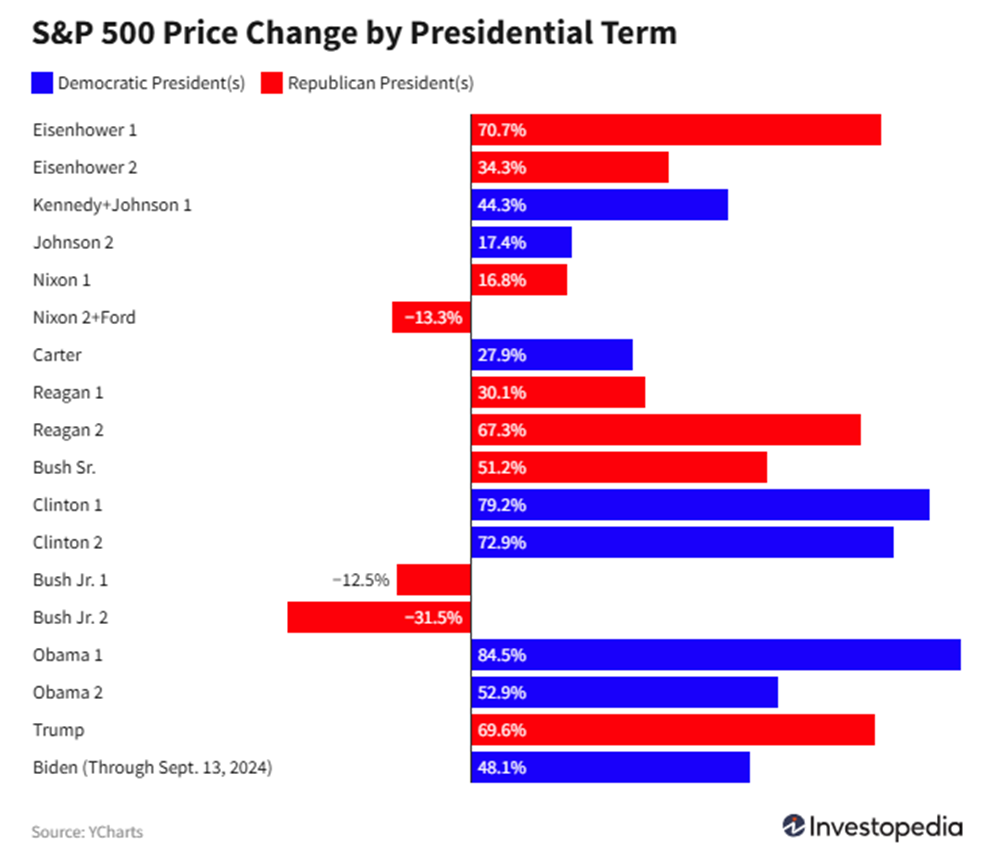

Below is a chart from a recent Investopedia article regarding performance of the S&P 500 under various presidents going back to the 1950’s.

As you can see, the S&P’s performance was historically solid when Trump was president (up 69.6%). This gain, however, pales in comparison to Obama’s first term (up 84.5%) and both of Clinton’s terms (up 79.2% and 72.9%, respectively). Also, the performance metric shown for Biden’s term does not include his last four months of his term. As of late December, the S&P has increased 58% under Biden.

The chart also reveals negative performance during Nixon’s second term, and both terms of George Bush Jr. Does this mean they are primarily responsible for the declines? Simply because the market went up or down during a president’s term does not ipso facto prove the president was the cause. Let’s see why.

The performance of the stock market is, in actuality, affected by numerous economic factors and geopolitical events.

According to the research literature, here are some the major factors that drive stock market performance:

- Status of the economy: A strong economy (low unemployment, good GDP growth, wage gains) tends to lead to higher stock market returns; whereas a weak economy (recession) tends to lead to markets retreating.

- Interest rates: Low interest rates tend to boost stock prices, while high interest rates tend to hurt them. The Federal Reserve, and not the president, is in charge of setting the “federal funds rate” that, in turn, influences interest rates.

- Corporate earnings: Earnings must be reported quarterly and show how companies are doing financially. This enables investors to decide whether the stock price reflects the company’s value.

- Investor sentiment: Markets aren’t always rational. Rich investors (the richest 10% of Americans own 93% of all stocks) might start worrying about a recession or other negative conditions. The stock market is forward looking, and investors are always trying to guess what is going to happen next and how it might affect a company and its profitability.

- Geopolitical events: Wars can cause shortages and price spikes. For instance, war in the Middle East can affect oil prices, which, in turn affect energy costs for both American companies and consumers. We have also seen that pandemics and natural disasters can cause shortages and price spikes, which, in turn, affect investor sentiment.

Compared with the above factors, the president has much less influence on the stock market. The president does appoint cabinet secretaries and other officials who can influence economic conditions, such as the Secretary of the Treasury, the Secretary of Commerce, and the Chair of the Federal Reserve. Also, the president can work with Congress to pass fiscal spending legislation, which influences market sentiment. But generally speaking, Congress and the Federal Reserve play more of role in influencing the stock market than the president.

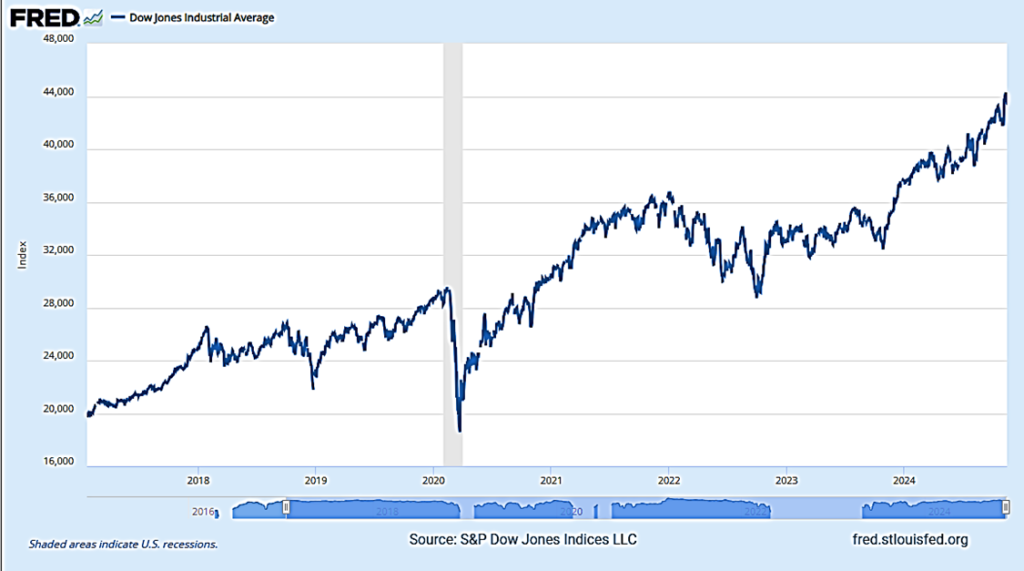

We can see the above-cited factors at work if we look at the stock market performance (Dow Jones) since the time Trump first came into office (2017).

You’ll notice the market went up early in Trump’s term, but there was a significant downturn in late 2018/early 2019. Six factors were responsible: Trump’s tariffs and the trade war with China and other countries; the Federal Reserve raising interest rates; big tech companies under scrutiny regarding data privacy and their role in the 2016 election; inflated company earnings and concerns stocks were overvalued; the Tax Cut and Jobs Act reduced the corporate rate, enabling corporations to buy back their stock, which further inflated prices; and a decline in investor sentiment due to the slow pace of job growth. Trump was involved with respect to tariffs and the tax cut legislation, but most of the other factors were outside of his control.

You’ll also note a very sharp decline early in 2020, which, obviously, was due to the Covid-19 pandemic and the recession (gray shading) that ensued. Trump had no role in creating this drop.

You’ll also note that the market rose steadily during 2021, but in 2022 it began to tumble. Reuters attributed the drop to policies and actions of the Federal Reserve and Russia’s invasion of Ukraine:

“The main factor cited by investors and analysts for the market’s weakness is the policy change at the Federal Reserve. As the pandemic took hold, the U.S. central bank put in place emergency policies to stabilize the economy that investors say also emboldened buying of stocks and other riskier assets. But the Fed early in 2022 signaled it was pivoting to tighter monetary policy in order to tamp down surging inflation, a significant change to the investing environment. Beyond the Fed’s change, Russia’s war in Ukraine has fueled further economic uncertainty. For example, the turmoil has caused a supply shock that has helped drive up oil and other commodity prices, while also triggering particular concerns about Europe’s economy.”

Reuters, May 10, 2022

Biden had no role in raising interest rates or Russia’s invasion of Ukraine. There was high inflation worldwide due to the Covid-19 pandemic and supply chain problems.

If you want to go back further in time, you can see how the above-cited factors affected the market during the two terms of President Bush Jr. First, he inherited the dotcom bust, which created a recession in 2001. This downturn was made worse by the terrorist attacks of September 11, 2001. The market rebounded somewhat in 2004 and 2005, due to low interest rates and a nationwide housing boom. But this housing bubble popped in late 2007, bringing the worst recession since the Great Depression. GDP plummeted and unemployment skyrocketed, causing the S&P 500 to have its worst year since 1929.

In summary, it’s absurd for presidents to claim 100% of the credit when the market goes up, or to be pinned with 100% of the blame when the market goes down. We should instead be looking for economic factors and geopolitical events that explain the market’s performance. And, yes, a president can have some effect on the market; but we need to be able to tie the market swing to specific policies and actions of that president.

While over three-fifths of Americans own stock, performance of the market is almost entirely driven by high-net-worth investors, large global corporations, and the capital market high finance.

The richest 10% of Americans own 93% of all stocks. Meanwhile, as of the third quarter of 2023, the bottom 50% of Americans held just 1% of all stocks. The bottom 50% of households held just $0.3 trillion in stocks, while the top 1% of households held over $16 trillion in securities.

Gallup reports that some 61% of Americans own stock. But most of us are small potatoes when it comes to investments. The wealthiest Americans have most of their assets tied up in equities, while most other Americans have their assets tied up in housing. Yes, if your income exceeds $100,000, 84% of you own stock. But your holdings represent just a tiny fraction of all money invested in the stock market. In fact, the percentage of all stocks owned by the richest 10% of Americans (93%) is the highest percentage ever recorded.

A March 2024 CNBC report headlined that the wealth of the top 1% hit a new record of $44.6 trillion at the end of 2023. The article went on to state: “The total net worth of the top 1%, defined by the Fed as those with wealth over $11 million, increased by $2 trillion in the fourth quarter. All of the gains came from their stock holdings. The value of corporate equities and mutual fund shares held by the top 1% surged to $19.7 trillion, from just $17.65 trillion the previous quarter.”

Ask yourself some important questions. Do you think these high-wealth investors and large global corporations have you in mind when it comes to buying and selling stock? When they pull out of the market and cause it to drop in order to protect their investments, who is left holding the bag? Is the drop in the market something the president caused? And do you think the tiny amount you invest in comparison gives you any leverage to control high-wealth investors or the performance of the market?

We need to face reality. It’s good that so many Americans have the ability to invest in the stock market. But the real players and the ones making money and controlling outcomes are the high-wealth investors. The stock market is not the “real economy” or the “main street” that represents average American investors, small independent businesses and investment institutions. Presidents or candidates who falsely claim credit for good performance or wrongly assign blame for poor performance are simply out to get our votes. Before we believe them we need to see hard evidence that their policies and actions actually caused what they claim.

Conclusion

Too many Americans have been lured into believing that presidents make a defining difference in the performance of the stock market. Politicians, political parties, and their media allies claim credit and assign blame based on the notion that presidents are responsible for market performance. We are also told that stock market performance defines the strength or weakness of the economy. As a result, we’ve been duped into choosing sides. Our party’s candidate is almost always the reason the market goes up, and the other party’s candidate is almost always the reason the market goes down. We love our candidate and political party because they make our 401k’s go up and keep the economy strong; and we hate the other candidate and political party because they ruin our finances along with the economy.

The fact of the matter is that the stock market has performed well under most presidents, regardless of political party. It’s good that so many of us can share in this bounty. But it shouldn’t be a partisan matter except when there is clear evidence that a president actually caused the change in market performance. Finally, as we invest, we need to keep in mind that the stock market isn’t the economy. Rather, it’s the primary investment playground for rich Americans. And they will do whatever is necessary make money and protect their investments.

Leave a Reply