In this final post of the series, I’ll predict what will play out in the coming months as Democrats and Republicans clash over federal spending, deficits, the Debt Ceiling, and national debt. I’ll describe why the likely outcomes will only perpetuate and worsen the problems. And, finally, I’ll close with some thoughts on a way forward.

The Partisan Narratives and What is Likely to Play Out

To begin, let’s recount the partisan narratives that will frame the clash. Republicans insist that Biden and the Democrats are to blame for reckless spending, huge annual deficits, and the intolerable national debt. They insist that massive spending cuts and drastic measures are required. Republicans, who now control the House of Representatives, have been demanding that any increase in the $31.4 trillion Debt Ceiling must be paired with spending cuts; but so far are not unified on any specific demands. Democrats insist that Republicans are out to drastically cut Social Security, Medicare, and Healthcare. Further, Republicans are to blame for huge deficits and national debt because they cut taxes during their watch rather than reduce deficits and the national debt. Deficits and national debt have exploded under Republican control.

What’s the likely outcome? There is historical precedent to inform us if we go back to the November 2010 Midterms, when Republicans captured control of the House of Representatives. Barack Obama was President, and Democrats controlled the Senate, just as today. With the great recession of 2008-09, massive stimulus packages were passed by both the Bush and Obama Administrations in the 2008 and 2009. Spending shot up by well over $500 billion in 2009 (from $2,983 billion to $3,518 billion) and dropped slightly to $3,457 billion in 2010. Annual deficits soared to $1.4 trillion in 2009, and to $1.3 trillion in 2010. Thus, as Republicans came into power in January 2011, they were laser-focused on spending and deficits. And, since they controlled the House through the remainder of Obama’s term in 2016, there is substantial history to inform our inquiry.

For starters, the chart below displays key outcomes in terms of spending, annual deficits, and national debt from the period of 2011 to the end of Obama’s term.

| Year (FY) | Spending | Annual Deficit | Total National Debt |

| 2011 | $3,603 billion | -$1,299 billion | $14.76 trillion |

| 2012 | $3,527 billion | -$1,076 billion | $16.05 trillion |

| 2013 | $3,455 billion | -$680 billion | $16.72 trillion |

| 2014 | $3,506 billion | -$485 billion | $17.79 trillion |

| 2015 | $3,692 billion | -$442 billion | $18.12 trillion |

| 2016 | $3,853 billion | -$585 billion | $19.54 trillion |

| 2017 | $3,982 billion | -$665 billion | $20.21 trillion |

As you can see, with Republicans in control of the House, and with Democrats in control of the Presidency and the Senate, spending was reduced or augmented in the range of $100 to $200 billion per year. Annual deficits were gradually reduced from over $1 trillion to a range of $450 to $675 billion per year; but they remained very large. And, finally, there was no success in limiting the national debt, as it shot up from $14.76 trillion in 2011 to $20.21 trillion in 2017.

Republicans used a full range of strategies to secure these results (see, “The Fiscal Fights of the Obama Administration,” Brookings Institution, December 8, 2016). On several occasions they imposed demands on extension of the debt limit, but ultimately relented. There were also agreements to “suspend” rather than “extend” the Debt Ceiling. Initially, Republicans argued the necessity of deep cuts to Social Security and Medicare, but they eventually relented. Republicans also demanded spending concessions that led to a government shutdown in October of 2013. And they exacted spending concessions via numerous Continuing Resolutions and Consolidated Appropriations packages that limited and controlled spending to some degree.

What’s Likely to Play Out in 2023?

Now let’s fast forward to 2023 and predict what is likely to happen. In the current negotiations, the Republicans will most probably draw from the same playbook. We already know they have taken deep reductions to Social Security and Medicare off the table. Given that these entitlement programs and defense constitute a huge portion of federal spending, this makes it highly unlikely that major cuts to federal spending will be adopted. Thus, Republicans will threaten, but most likely relent on the condition of major cuts in exchange for extending the debt limit. Instead, they will call for cutting spending back to a prior level or to some specified metric. They will probably also call for automatic cuts to be triggered in the event that spending goals aren’t met. There will be brinkmanship and last-minute deals, numerous short-term extensions (Continuing Resolutions), a probable shutdown or two of the federal government, and some very anxious times in terms of the debt limit.

When all the dust settles, it is likely that Republicans will be successful in flattening spending over the next few years. For instance, it’s possible that 2024 spending could be reduced below 2022 levels ($6,272 billion). Otherwise, my guess—and this is just a guess—is that spending over the next few years will be up or down in the range of $200 billion per year. Also, it extremely likely that Republicans will block any tax increases. But annual deficits will remain high, and the national debt will continue to climb, along with interest costs.

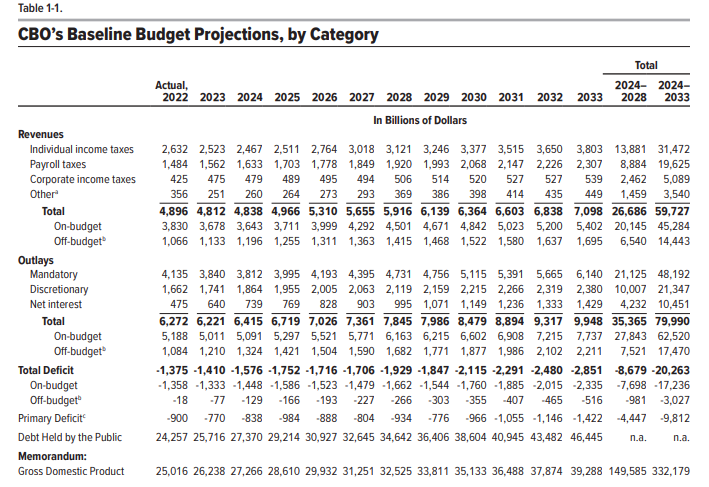

A look at the recently released Congressional Budget Office 10-Year Budget Projections (February 15, 2023) serves to confirm these conclusions.

If we look at projected outlays (spending), we see that total spending is projected to go down slightly in 2023 ($6,221 billion), and then increase by about $200-$300 billion per year over the next several years. It is thus plausible that the Republicans could be successful in further limiting or even reducing year-to-year spending, at least for a few years.

But now focus on the projections regarding “Total Deficit.” We see that the Total Deficit is already at a very high level ($1,375 billion for 2022), and is projected to grow to $1,752 billion by 2025, and then climb to $1,929 billion by 2028. Thus, even if spending reductions in the range of $200 billion per year were adopted over the next few years, the deficits would remain very high. Further, such reductions would do nothing to reduce the total national debt, which is projected to grow at over a trillion dollars per year (see chart above).

Finally, look at the projected costs of “Net Interest,” which is $425 billion in 2022, and will go to $640 billion in 2023, $739 billion in 2024, and $769 billion in 2025. These are the costs of carrying the huge national debt that will continue to climb despite any spending cuts secured by Republicans. Thus, our capacity to spend on important priorities will increasingly be constrained because of interest obligations.

In summary, Republicans will likely have a modest degree of success in flattening spending; and they will surely be able to block any tax increases. But it’s also very likely that annual deficits will remain very high, that total national debt will continue to climb, and that interest obligations will increasingly limit spending on other priorities.

How Do We Break Out of the Partisan Rubric?

We need to start with ourselves—everyday Americans who care about their country. We need to put aside the simplistic, misleading, and demonizing partisan narratives, and focus instead on a more balanced and sophisticated understanding of the problems. That is what we have attempted to do in this series of posts. The quest is to understand and solve problems by looking for common ground and respecting differences, knowing that compromise will be necessary in order to reconcile differences. As we learn this new discipline, we should practice and share it with others.

We then need to tell our elected leaders that we expect them to work together to solve problems instead of blaming and blocking one another. We need to give them permission to compromise and pursue middle-ground solutions instead of either imposing their will or walking away. And we need to tell them that we’re done voting for or contributing to them if they aren’t willing to change their ways. And, finally, we need to do the same with the media outlets that we rely upon. We need to vote with our feet—walk away from media outlets that are highly partisan and divisive, and tune into outlets that provide balanced and in-depth reporting.

The key to breaking out of this highly partisan rubric involves a major shift of focus. Instead of each party blaming one another for creating problems and attempting to impose its will at all costs, they need to focus on understanding the problems and working together to address them. This shift of focus can be transformational in lessening the anger and division that grips our country. Let’s see how with an example.

Federal Government’s Response to Covid-19: Working Together to Address a Problem

By the first few months of 2020, Covid-19 had become a worldwide pandemic emergency. In the US alone, over 1 million people eventually died, 20 million lost or left their jobs, tens of thousands of businesses halted operations or faced insolvency, health care systems faced collapse, and supply chains were disrupted worldwide. The US economy was thrown into recession.

The federal government responded to these tragic and urgent conditions. It procured medical supplies and equipment, it launched efforts to provide therapies and vaccines, and it adopted various relief packages to assist the unemployed, help businesses survive, and support health care systems. Five stimulus packages were adopted, four of which were enacted during the Trump Administration: The $8.3 billion Coronavirus Preparedness and Response Supplemental Appropriations Act (March 3, 2020), the $104 billion Families First Coronavirus Response Act (March 18, 2020), the $2.2 trillion “CARES Act” (March 27, 2020, the $900 billion Consolidated Appropriations Act, 2021 (December 27, 2020), and the $1.9 trillion American Rescue Plan Act of 2021 (March 11, 2021). The total spending on these Covid response and stimulus packages was $5,112 billion.

Because of these relief and stimulus packages, tens of millions of Americans had a source of income to buy groceries, pay rent and other expenses, and support their families. Businesses were able to keep operating and meet payroll. Vaccines and other therapies were developed and hundreds of millions of Americans were shielded from serious disease or death. The recession ended as the shortest ever, GDP growth surged, and unemployment levels eventually reached a 50-year low. Looking back, we can acknowledge that these stimulus packages (and those of other countries) contributed to high inflation, and that some of the money was misspent. But there is no doubt that these relief and stimulus packages were necessary and effective.

However, because of these emergency efforts and major spending to address the Covid-19 pandemic, our deficits soared greatly in 2020 and 2021. This emergency spending also added greatly to the ever-increasing national debt. In short, we had to spend big to address an emergency, and this spiked our deficits and the national debt.

In this context, America faced a problem or challenge. We incurred greater deficits and an increased national debt because we responded to an emergency facing the country. Neither President Trump nor President Biden, nor any members of Congress created the Covid-19 pandemic. The country desperately needed the federal government to respond, and it did. Does it make any sense that we blame President Trump and the Republicans for the huge increases in deficits and the national debt that occurred because they proposed and voted for 4 of the 5 relief packages that were adopted? Or, does it make any sense that we blame Republicans and Democrats respectively for spending on relief and stimulus packages when they were in control? Rather, doesn’t it make a lot more sense to regard the Covid-19 pandemic and recession as a problem that faced America, and we needed the President and Congress to come together on solutions?

Applying this approach, our country now faces some major problems with respect to federal spending, increasing deficits, and the huge national debt. Don’t we want the Republicans and Democrats to actually work together to address these problems? What has been accomplished via decades of blaming and demonizing one another with narratives that have proven to be simplistic, misleading, and sometimes hypocritical? Very little. Instead, imagine what could happen if Democrats and Republicans worked to gain a sophisticated understanding of the problems and recognized one another’s legitimate concerns? When there was disagreement, what if they attempted to reconcile their differences without blaming one another and walking away? What if they focused on common interests and solutions that involved give and take? Don’t you think the resulting solutions would be more effective and robust than those resulting from the highly partisan blame game rubric? And don’t you think these bipartisan solutions and behaviors would help heal the partisan divide, anger, and frustration that grips our country?

Final Thoughts on the Path Forward

It’s going to take a while to break out of the partisan blame game rubric. We have a lot of work to do if the transition to cooperative problem solving is ever going to occur. I’m hopeful that this deep dive into federal spending, deficits, and the national debt has illustrated the value of a sophisticated and balanced understanding of problems in lieu of the blame game rubric. Someday, hopefully, our policymakers will work together to actually confront the following problems and potential solutions:

- There is too big of a gap between what we spend and what we take in annually. A 3-4% difference between spending and revenues (percentage of GD\P) results in deficits that are too large; and ongoing deficits have driven up the national debt. The costs of interest have become too great, and limit spending on important federal priorities.

- The federal government often incurs substantial additional spending in order to address extraordinary conditions; and when this occurs deficits and the national debt are driven up further. No one is there to bail out the federal government when these conditions occur. And the timing of these conditions can’t be predicted, nor can the magnitude of expense. Most countries of the world thus operate with annual deficits and considerable national debt.

- Historically, federal spending increases can be viewed as moderate when seen in the light of inflation and population growth, or in light of increases in spending for state and local government. A spending level of 22-23% of GDP is not unreasonable, especially if deficits and the national debt are to be addressed.

- It is not necessary to totally eliminate annual deficits and the national debt. It is more feasible to bring deficits and the national debt to some percentage of GDP which is based on prior history, and which could be tolerated. Further, a considerable period of time should be allowed to achieve these standards.

- Reducing taxes is counterproductive to increasing revenue and lessening the gap between what we spend and what we take in. The Tax Cut and Jobs Act of 2017 expires on December 31, 2025. Neither these tax cuts or others should be renewed or enacted until policy is in place to address deficits and the national debt.

- If we are to reduce or eliminate the gap between what we spend and what we take in, it will require both spending cuts and revenue enhancements. The magnitude of deficits and the national debt cannot be remediated with spending cuts alone. Most of the gap between spending and revenues should be closed with revenue enhancements.

- In considering revenue enhancements, wealthy individuals, corporations, and businesses are probably most able to be taxed at higher levels.

Thank you, my friends, for reading to the end. Here’s to a better America!

EXPLORE THE WHOLE SERIES

Federal Spending and the National Debt

Brinkmanship on the Debt Limit: There’s a Better Way to Gain Control of Federal Spending and the National Debt (1 of 10)

An Objective Framework for Understanding the Problems Related to Federal Spending, Deficits, and the National Debt (Part 2 of 10)

Federal Spending (1980-2023): What Insights Can We Gain? (Part 3 of 10)

Federal Deficits and Total Federal Debt (1980-2023): What Insights Can We Gain? (Part 4 of 10)

US vs. Other Countries: How Do We Compare on Spending, Deficits, and Debt? (Part 5 of 10)

Revenues (1980-2023): What Insights Can We Gain? (Part 6 of 10)

Additional Insights on Federal Spending (Part 7 of 10)

Key Insights Gained From the Analysis of Federal Spending, Deficits, and Debt (Part 8 of 10)

Potential Solutions to Address Federal Spending, Deficits, and Debt: Applying Research and Insights as Opposed to Partisan Dogma (Part 9 of 10)

Leave a Reply