When asked about the US economy and inflation, those on the right view the situation as dire. They lament that President Biden and the Democrats have destroyed the booming economy created by Republicans. The country is in a recession. Inflation is out of control—reaching a four-decade high—caused by reckless and excessive spending by Democrats. The costs for gas, groceries, pharmaceuticals and just about everything else have skyrocketed. The vast majority of Americans are hurting, and Democrats just want to raise taxes and spend more money. Irresponsible spending has also led to record levels of national debt and huge budget deficits.

Those on the left have an entirely different view. They assert that the US economy was rocked by the worldwide Covid-19 pandemic resulting in supply chain disruptions, high inflation, high gas prices, a recession, and 20 million unemployed Americans. Responsible stimulus spending by President Biden and the Democrats enabled a robust economic recovery, record levels of job creation, record lows in unemployment, and solid gains in the gross domestic product (GDP). High inflation and gas prices accompanied this economic boom and were further exacerbated by Russia’s war with the Ukraine. However, both are coming down. As to blame, it was Trump and the Republicans who created record levels of national debt and deficits. And it is Trump and the Republicans who cut taxes for corporations and the rich but want to slash spending that helps poor and middle class Americans.

In a prior post, I explored how the “Hyper-Partisan Blame Game Rubric” is both entrenched and dysfunctional, not only because it stokes anger and division, but also because it thwarts problem solving. The rubric ignores that most problems are multi-faceted, and instead pins blame on a President and/or political party using simplistic and repeatable narratives.

Multiple Factors Contributed to Problems for the US Economy

1. The Covid-19 Pandemic: The worldwide Covid-19 pandemic resulted in massive economic dislocations that lasted from early 2020 until at least the end of 2022. The United States and most countries of the world suffered high levels of unemployment, high inflation, recessions, and supply chain problems. Businesses and government services such as education were forced to close or drastically reorganize. The government of virtually every country in the world responded with medical interventions and stimulus relief packages for individuals, businesses, health care providers, and government agencies.

Covid-19 was not caused by President Trump, President Biden, or either of the political parties. Rather, Covid-19 was a public health emergency that demanded a response from all levels of government. It created huge disruptions that required unprecedented spending and government action to save lives and get the economy back on track. The Covid-19 emergency and the necessary responses resulted in negative economic conditions, including: high inflation, high unemployment, a recession, and massive government spending that created record annual deficits and a skyrocketing national debt. With the possible exception of the American Rescue Plan Act of 2021 (treated separately below), these negative conditions were not caused by Democrats or Republicans.

Finally, if you’re interested in a more thorough and technical exploration of why inflation increased in connection with the Covid-19 pandemic, I recommend “Understanding US Inflation During the COVID Era,” an October 2022 paper. This paper provides additional evidence that the major disruptions brought about by Covid-19 were the primary cause of increased inflation.

2. The American Rescue Plan Act of 2021: President Biden signed the $1.9 trillion American Rescue Plan Act into law on March 11, 2021. Republicans have argued that this stimulus package was unnecessary, and that it was responsible for the big increases in inflation in 2021 and 2022.

For perspective, there were five relief packages enacted by the federal government in 2020 and 2021 that resulted in a spending total of $5.112 trillion. Four of the five measures were signed into law by President Trump for a total of $3.212 trillion. The $2.2 trillion CARES Act was signed into law by President Trump on March 27, 2020; and the $900 billion Consolidated Appropriations Act of 2021 was signed into law by President Trump on December 27, 2020. The appropriations for these two measures were still being spent in 2021 and 2022.

Soon after The American Rescue Plan Act was signed into law, the inflation rate jumped to 4.16% (April 30, 2021), reached 7.04% by the end of 2021, and peaked at 9.06% on June 30, 2022. Economists have argued about the extent to which the American Rescue Plan Act contributed to high inflation. During 2021 and 2022, inflation was increasing around the world. According to Statista, the global inflation rate for 2021 was 4.7%, and by 2022 reached 8.73%. The fact that inflation was increasing around the world during 2021 and 2022 argues that it was a worldwide phenomenon rather than the result of the The American Rescue Plan Act.

Also, if stimulus spending was contributing to high inflation, it would be reasonable to include stimulus spending enacted under President Trump. That spending was over 60% of all stimulus spending, and recipients were still spending these funds in 2021 and 2022. Further, while high inflation is undesirable, it may have been the price we paid to avoid long-term economic calamity. These conclusions are corroborated by the Business Insider (“High inflation is the bill coming due for Trump and Biden’s stimulus that kept us out of a Great Depression”, Business Insider, November 10, 2021).

3. Russia’s Invasion of the Ukraine: On February 4, 2022, Russia invaded the Ukraine, setting off economic impacts both globally and domestically. The US inflation rate spiked immediately thereafter (7.87% by February 28, 8.54% by March 30, and topping out at 9.02% on June 30). Via economic sanctions and other actions, Russia’s war in Ukraine caused a profound shift in the world’s oil markets, and significantly increased US gasoline prices in the short run. By the end of February, the US average gas price had increased from $3.44 to $3.60 per gallon. It then increased to $4.23 by the end of March, to $4.59 by the end of May, and topped out at $5.00 a gallon in June, before returning to $3.53 a gallon by the end of November 2022 (US Energy Administration Information). The effect on oil prices thus proved to be short-lived, as the oil market has mostly absorbed the impact of Russia’s invasion of the Ukraine.

The evidence cited above suggests that Russia’s invasion of Ukraine was a key factor in driving up inflation and gas prices to peak rates during the period of February through June of 2022. That is, the invasion of Ukraine was the factor that was largely responsible for driving inflation and gas prices from high to record levels. Also, earlier allegations by Republicans that gas prices had increased because President Biden reduced US oil production have been proven false.

4. Actions and Inactions by the Fed: When it comes to controlling the US economy, Presidents and Congress have limited authority. Instead, most legal authority is vested with the Federal Reserve System (Fed), which serves as the central banking system for the country. The Fed–and not the US President—is in the driver’s seat when it comes to addressing high inflation, interest rates, and other economic conditions.

If we study prior periods of high inflation in the United States, we’ll see that they were a response to changes in the business cycle, the natural rise and fall of economic growth that occurs over time. When inflation rates surge—the Fed’s target is to keep annual inflation at 2% or less—the historic response has been to raise interest rates. Doing so slows down the economy and gradually brings down the rate of inflation. It typically takes many months or more than a year to return inflation rates to acceptable levels. Unfortunately, the solution also involves some difficult side effects. In particular, higher interest rates make it harder for businesses and individuals to borrow money and pay down debt. Also, higher interest rates have tended to lead to higher rates of unemployment. Finally, if interest rates are raised too aggressively, the economy could fall into recession.

One of the issues with the Fed’s response is whether it waited too long—almost a year—to raise interest rates. In the month between March and April of 2021, the annual inflation rate spiked from 2.6% to 4.2%. By June it had increased to 5.4%, and by December to 7%. Yet it wasn’t until March 17, 2022, that the Fed finally raised its federal funds benchmark rate; and by then the annual inflation rate had reached 8.5%. The Fed’s increase was a modest 25 basis points, to the range of 0.25% to 0.50%.

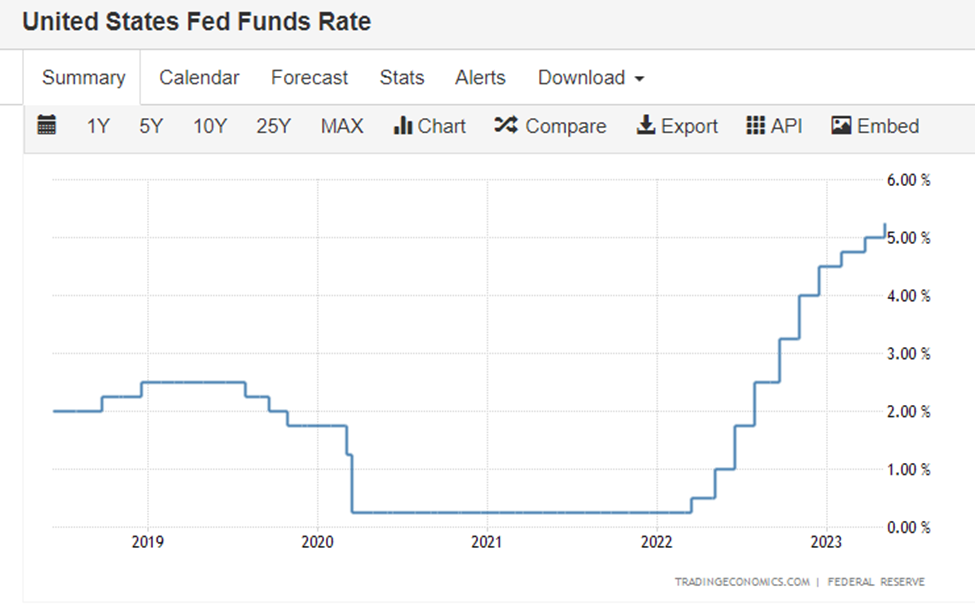

The graph below depicts the Fed’s actions on raising the federal funds benchmark rate since March of 2022. As of May 2023, there have been 10 consecutive increases in increments of 25 to 75 basis points and overall benchmark rate is 5.25%–the highest since 2007.

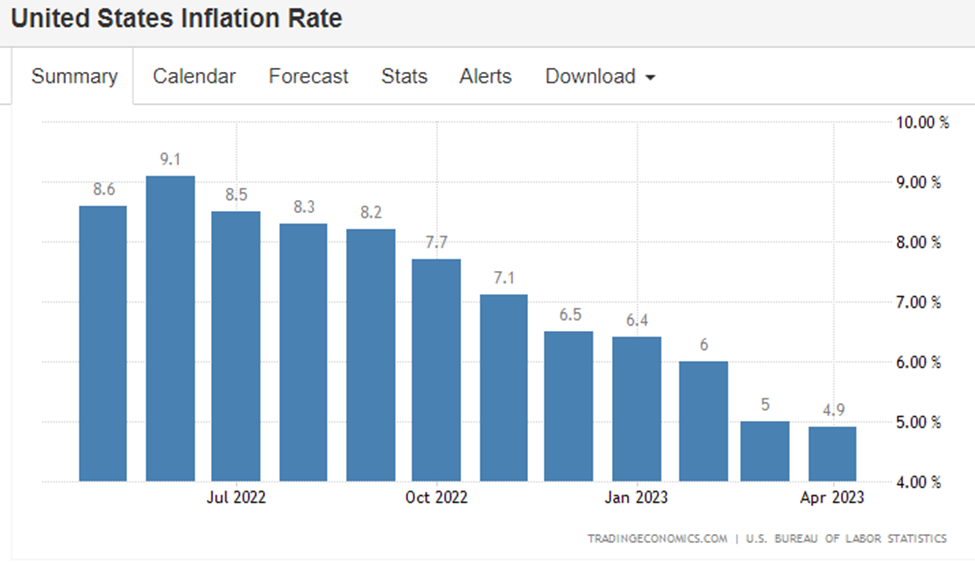

The aggressive actions to raise interest rates appear to be having the desired effect. As the graph below shows, since peaking at 9.1% in June of 2022, the annual inflation rate has steadily declined, dropping to 4.9% by April of 2023.

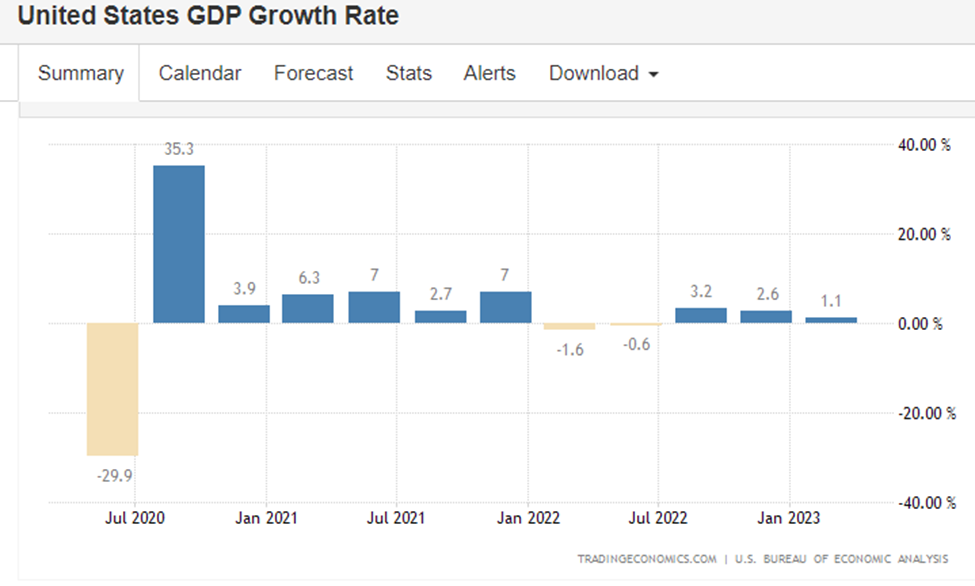

While inflation has been significantly reduced through action of the Fed, the country appears to be escaping the difficult side effects mentioned above. Unemployment remains at record low levels. However, as shown in the graph below, GDP growth rates have definitely slowed since the Fed started raising interest rates. The first and second quarters of 2022 showed actual declines in GDP, after several quarters of robust growth. GDP growth has since rebounded in the third and fourth quarters of 2022, but was very modest (1.1%) in the first quarter of 2023.

In short, we’re not out of the woods. A recession is still possible. Also, with higher interest rates, many Americans are wrestling with credit card debt and finding it difficult to finance big ticket purchases such as automobiles or houses. Businesses also struggle with increased borrowing costs. Again, these risks and the pain faced by the people and businesses are the result of actions by the Fed—not the President and the parties in power. Neither the President nor Congress has authority to control or direct the actions of the Fed as it continues to administer the strong medicine needed to get the economy back on track.

5. Record Profits for Many US Businesses (including oil companies as well as grocery chains and suppliers): When a business simply passes on its higher costs of doing business to consumers one can hardly argue that the business is responsible for increasing the rate of inflation. However, there is considerable evidence that US businesses have been doing more than simply passing on increased costs; rather, they have also been expanding profit margins. When this happens businesses themselves contribute to an increase in the rate of inflation. Here is some evidence:

- As to corporate profits generally, profits in the nonfinancial sector hit a record high of $2.08 trillion in the third quarter of 2022. These profit numbers represent more than passing the costs of inflation on to consumers:

“Companies have passed higher costs on to customers. But they have also taken advantage of circumstances to expand profit margins. The broadening of inflation beyond commodity prices is more profit margin expansion than wage cost pressures . . . as resilience in demand has given companies the confidence to raise prices faster than costs.”

-Jerome Powell, Chairman of the Fed

- As to oil companies, Chevron, ConocoPhillips, Exxon and Shell all reported record profits in 2022. Over $1 trillion in sales were recorded, with Shell making nearly $40 billion in profits, Chevron making $36.5 billion, ConocoPhillips making $18.7 billion, and Exxon making $55 billion. When profits by BP and Total Energies are included. the total oil company profits for 2022 are over $199 billion.

- As to grocery suppliers and chains, here are some examples of massive profits reported in a recent issue of Time Magazine: Conagra Brands—one of the country’s largest consumer packaged goods companies—posted a nearly 60% year-over-year profit increase between December 2022 and February 2023. Kraft-Heinz reported that profits for the last quarter of 2022 were up nearly 450%, compared to the prior year. Tyson Foods more than doubled its profits between the first quarters of 2021 and 2022. And General Mills saw its fourth quarter 2022 profits rise 97% compared to the third quarter. Cal-Maine Foods, the largest egg producer in the U.S., reported that its revenue doubled and profit surged 718% in the last quarter of 2022.

When US businesses raise prices in order to expand profit margins rather than simply cover the cost of inflation and other costs of doing business, they cause the inflation rate to increase. Such increases in the rate of inflation are not the fault of Presidents or the parties in power. Further, consumers are the ones who pay the price for these businesses to become more profitable.

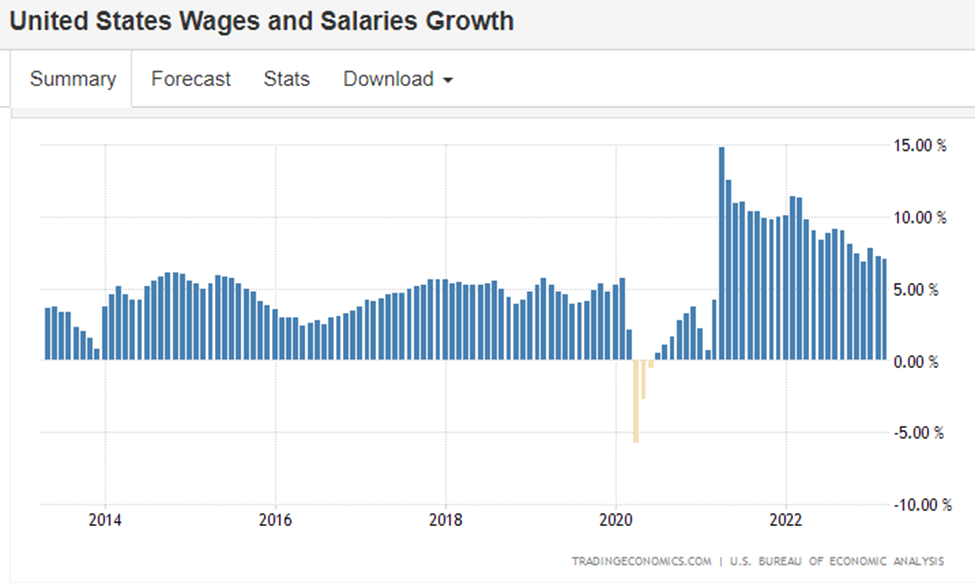

6. Higher Wages: With the onset of the pandemic, 20 million Americans lost their jobs or dropped out of the labor market. Then, as the economy began to recover (with the help of stimulus packages), the labor market tightened in 2021 and 2022, as there were huge numbers of job vacancies with low levels of unemployment (fewer potential applicants). Workers bargained for better pay, and firms responded with pay increases. This tightening of the labor market along with the rapid and significant wage increases pushed “core inflation” higher. The graph below clearly shows how wage growth spiked in 2021 and 2022, with monthly increases of 10-15% over the same month in the previous year. These rapid increases in wage growth were clearly a factor in the rate of inflation that had climbed to a high of 9.1% in June of 2022.

Presidents and the political parties have virtually no control over wages and salaries in the private sector. However, they have nonetheless been blamed when salaries either lag or exceed the rate of inflation. When wages and salaries lag the rate of inflation, politicians are criticized for not doing enough; and when wages significantly exceed the rate of inflation, they are blamed for worsening inflation. In addition, even though they have no control over wages, Presidents and political parties usually take credit when wage growth exceeds the rate of inflation. This paradox is yet another example of how hyper-partisan political narratives are both simplistic and absurd.

Rejecting the Hyper-Partisan Blame Game Approach

Once we consider the multiple factors at play, it is clear that problems with the US economy are not predominantly attributable to Presidents and political parties. Rather, problems with the US economy are largely caused by other factors, most of which are outside of the control of Presidents and political parties. Hyper-partisan narratives that blame individuals and their parties for creating economic problems not only misdiagnose the causes of such problems, but also doom efforts to address the factors that are actually causing the problems. And, perhaps worst of all, the narratives have left us angry, divided, and pessimistic regarding the economy and our economic prospects.

If we objectively look at the problems with our economy as Americans, and not as partisans, we should immediately reject the hyper-partisan blame game approach. President Trump was not to blame for Covid-19, the recession that ensued, the loss of 20 million jobs, and the huge deficit spending necessary to address the emergency. The stimulus packages passed under Presidents Trump and Biden, like stimulus packages passed all around the world, had some inflationary effects. Yet, neither Biden nor Trump was or is predominantly responsible for high inflation. Other powerful factors that induced higher inflation were also at play, including Russia’s invasion of the Ukraine, wage inflation, and the fact that so many American businesses chose to expand their profit margins rather than simply recover the costs of inflation. Also, the pain felt by many Americans and American businesses because of increased interest rates was not caused by President Biden and the Democrats; rather the pain is part of tough medicine being administered by the Fed, which is outside the control of the President and the political parties.

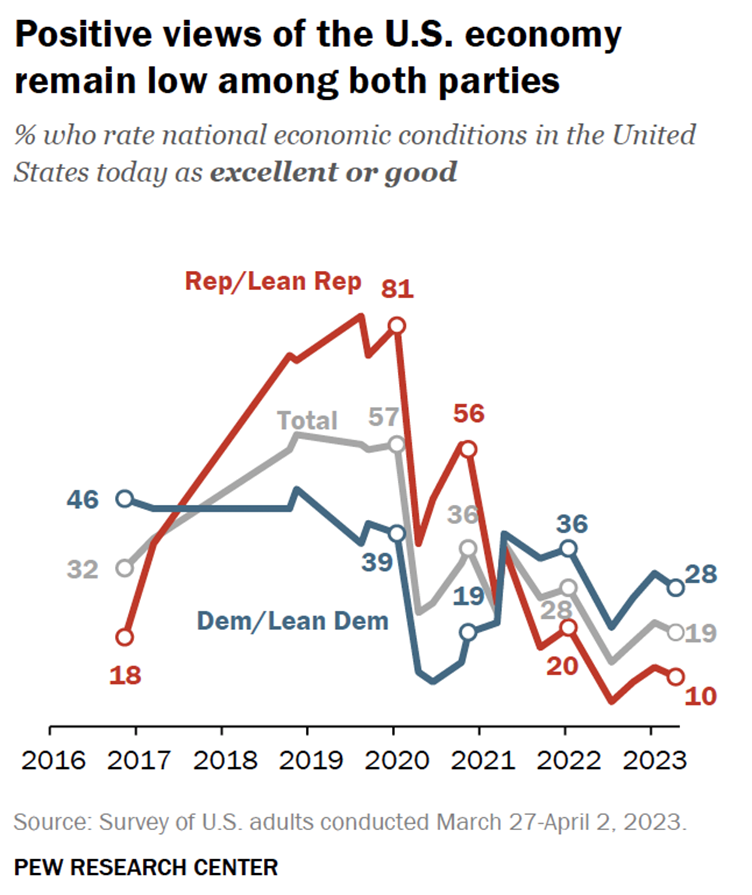

The graph below illustrates how views about the US economy are not only deeply embedded along partisan lines, but also very negative in nature. When Trump was in power, Republicans had very positive views, while Democrats had negative views. With Biden in power, Republicans reversed their views and Democrats became more positive for a time, but remain mostly negative. As each party continues to trash the other, the American public—put through the wringer with the Covid-19 pandemic—can’t help but feel negative about the future.

On a daily and hourly basis we see and hear that Biden and the Democrats have ruined the economy, created record inflation, spent recklessly, created record deficits and national debt, increased taxes, and caused the vast majority of Americans to struggle to make ends meet. We also see and hear that Republicans cut taxes to benefit corporations and the rich, created their own record deficits and national debt, and want to slash spending for programs that help poor and middle-class Americans make ends meet. And we also witness our elected representatives pounding on these narratives, demonizing one another, and taking the country to the brink of default on the debt limit. They can’t seem to get anything done unless there is a crisis. Is it any wonder why Americans are so angry, divided, and pessimistic when it comes to the US economy and our future prospects?

The Way Forward

In many respects the US economy is in much better shape than we have been led to believe via the hyper-partisan narratives. Just three years ago we were in the midst of a pandemic that took the lives of over a million Americans, put 20 million out of work, provoked a recession, and jolted every aspect of our economy. Through stimulus programs and government action, we tamed the pandemic and got the economy back on track. The job loss has been restored, and more jobs have been created since 2021 than any other time in our history. Unemployment is at a 50-year record low level. Wage gains are being realized. The runaway inflation rate has been tamed from 9.1% in June 2022, to 4.9% this April. Gas prices have come down, and are now within about 50 cents per gallon compared to pre-pandemic levels. We have avoided a recession.

Make no mistake, there’s far more to be done. We need to get inflation back in the range of 2%. We need to address income inequality, as the lowest paid 90% of Americans are falling further and further behind the top 10%, the top 5%, and the top 1% of wage earners. While respecting free enterprise and our businesses, should there be some controls when the profits they are making are causing the rate of inflation to increase and the money is coming out of the pockets of everyday Americans?

Part of the solution is to reject the hyper-partisan narratives that have caused us to misdiagnose the problems; thwart efforts to problem solve; and leave us angry, divided, and pessimistic. Most Americans are still fatigued and traumatized by the Covid-19 pandemic, and the onslaught of condemning narratives has not improved our perceptions of the economy. The other part of the solution is to focus attention on improving economic conditions for the vast majority of Americans who don’t yet feel the economy is working in their favor.

Going forward, each of us needs to be wary of hyper-partisan narratives, regardless of which side they may be coming from. We should take responsibility to validate new narratives, and be careful not to embrace or repeat those we know to distort blame or causation. We should inform our elected representatives and candidates for office that we reject such narratives, as they are thwarting efforts to problem solve and find middle ground. We should demand, or at least encourage, our elected representatives and candidates to set aside partisan rhetoric that pins blame on individuals and their political parties. Instead, they should cooperatively try to identify and address the multiple factors at play in causing a problem. In particular, they need to address growing income inequality, a problem that has left the vast majority of Americans behind in our economy. And, finally, each of us should spread the word to family and friends. We should help them understand the downsides of hyper-partisan narratives as well as the benefits of problem solving based on the multiple factors that are actually at play.

Leave a Reply